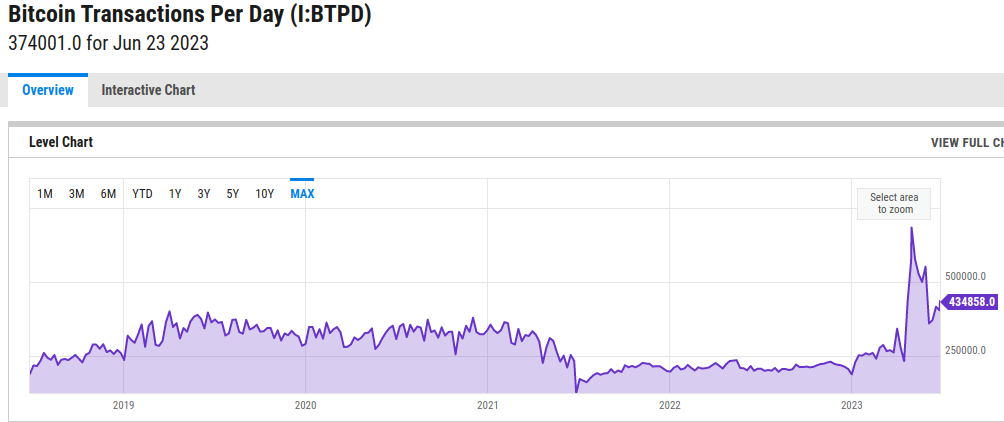

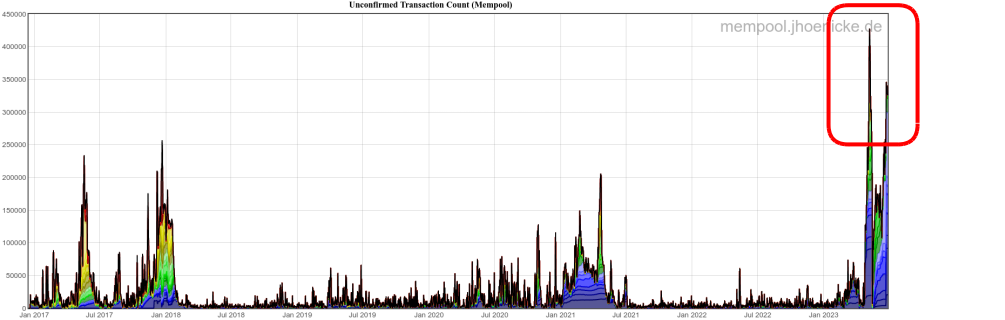

Let's check in on our ailing patient, Bob Bitcoin. For the past five weeks, Bitcoin has been averaging 500K to 600K transactions per day. However, it's also been exceeding 150K uncommitted transactions per day, making a new high of 485K last month.

550K transactions - 150K uncommitted = 400K sustainable transactions. Basically, the Bitcoin network is maxed out. More traffic creates more contention and more uncommitted transactions (as predicted in December).

In ten months or so, available coins will be halved to 165K, so miner income will halve. Let's run through the calculations again.

income: 330K coins X $27K = $8.9 billion

cost: 140 terawatts X $0.09/kwatt = $12.6 billion

net loss: $3.7 billion

Extrapolation for 1st Quarter, 2024

income: 165K coins X $27K = $4.5 billion

cost: 140 terawatts X $0.09/kwatt = $12.6 billion

net loss: $8.1 billion

Of course, all estimates are subject to change. Bitcoin price may shoot up, but the network is constrained to 400K transactions per day so... It's unlikely energy prices will drop in this pre-WW3 environment. New miners are unlikely since current miners aren't earning much. Miners can charge higher transaction fees but their current cost is

$12.6 billion / (400K/day x 365 days) = $86 per transaction.

Who is gonna pay $86? And who is gonna charge $86 to break even?

The percentage bet is that miners lose $5-7 billion in 2024, similar to the $5 billion loss in 2022.

If they abandon the coin halving scheme, the remaining 1.6 million coins will last 4.8 years.

Comments