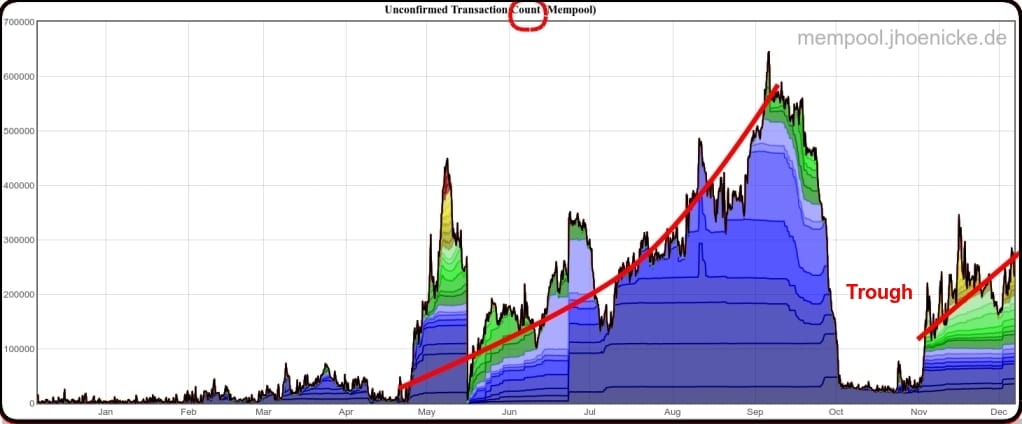

Bitcoin received more transactions than it could process from May to Sept, shown in the growing mempool (queue). Higher interest from impending ETFs, adoption by Argentina, etc, probably increased traffic and then dropped transactions increased even faster since no bandwidth is available.

Notice the sudden trough in October. After the trough, we see the queue restart but with a lower rate of increase so far. I'm pretty sure Bitcoin internals were reworked in Oct towards a higher transaction rate.

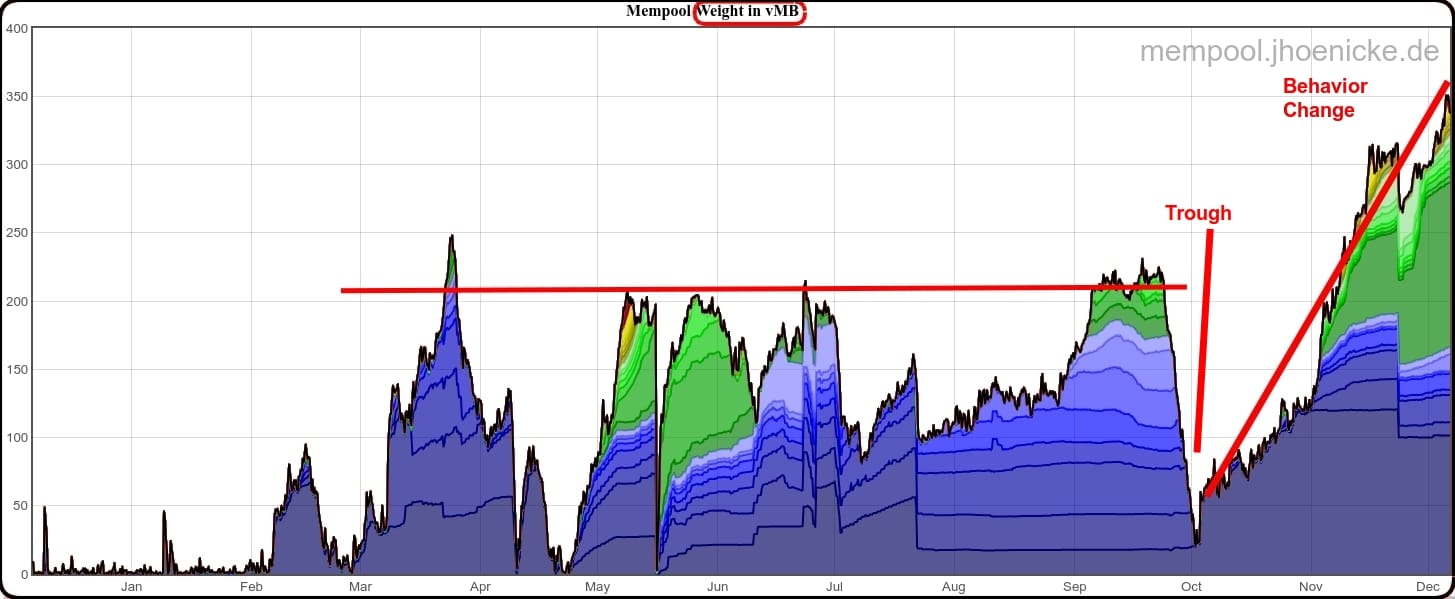

Now look at the same data but as megabytes of data instead of transaction counts.

Surprise! Now the count looks better but queued data is growing faster than ever, which is what I'd expect from recent price increases. They're aggregating transactions or changed a compression algorithm or something like that.

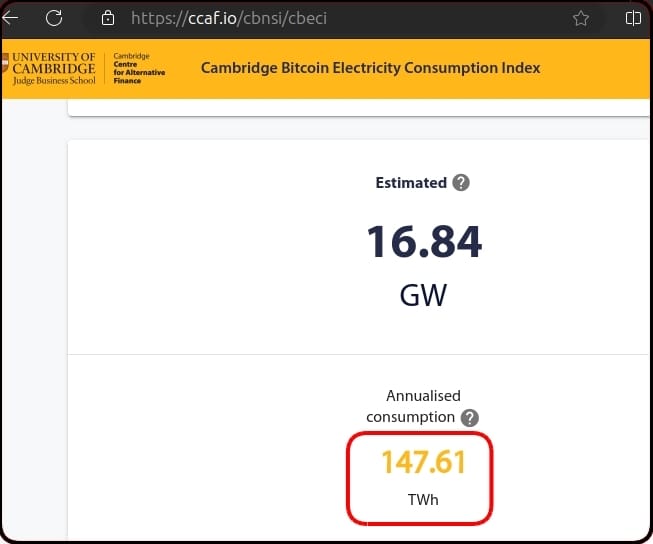

Let's look at 1st quarter of 2024. We know that 165,000 coins can be mined in 2024. We know that Bitcoin currently consumes 150 terawatts of power. And we know that $0.095 / kwatt is about the lowest cost in the US for commercial users.

150 terawatts at $0.095/kwatt means Bitcoin's energy bill is $14.25 billion.

What's the minimum coin price to pay $14.25 billion?

$14.25 billion / 165,000 coins = $86K per coin.

Bitcoin needs an $86K coin price to pay the energy bill in 2024.

The energy index spiked up to 163 terawatts last week, as would be expected from more transactions and I’m calculating with 150 terawatts but I think 2024 will reach 165 terawatts.

165 terawatts at $0.095/kwatt means Bitcoin's energy bill is $15.7 billion.

$15.7 billion / 165,000 coins = $95K per coin.

Comments