Overview

The fiat US Dollar is already older than all fiats of the past several hundred years and contrary forces are building against it. Russia and China have planned for its end since 2009, it is aging as the world reserve currency, and the current Federal debt is unsustainable.

Gold Standard

The longest period in modern history without a gold standard is now; from 1971 to 2023. The last gold standard was the Bretton Woods which operated from 1944 to 1971. The United States has abandoned its gold standard in unusual situations (Civil war, World War 1) but only for a few years.

Russian Gold Reserves

Since 2009, Russia's central bank has steadily increased gold reserves to diversify away from the US dollar and foreign currencies. Russia's gold reserves more than tripled from 600 metric tons in 2009 to over 2,300 metric tons in early 2021.

Chinese Gold Reserves

China has consistently increased gold reserves since 2009 to diversify away from US dollars and foreign currencies, similar to Russia. China's gold reserves grew from 1,054 metric tons in 2009 to over 1,948 metric tons in early 2021.

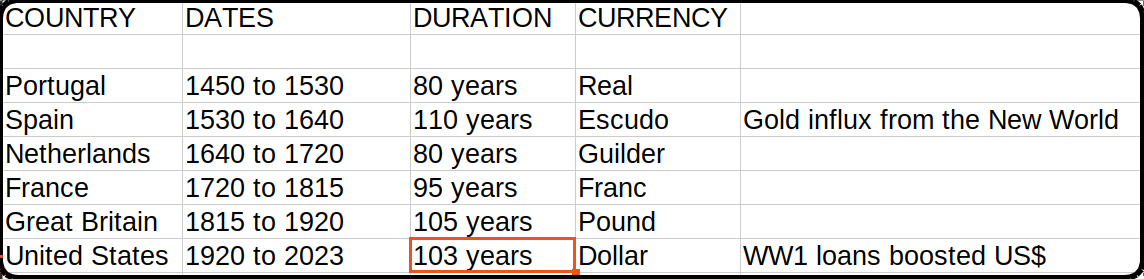

Hegemony

Western hegemonic empires have had an average lifespan of 95 years and the United States is at 103 years. The world reserve currency is usually a function of the current hegemony.

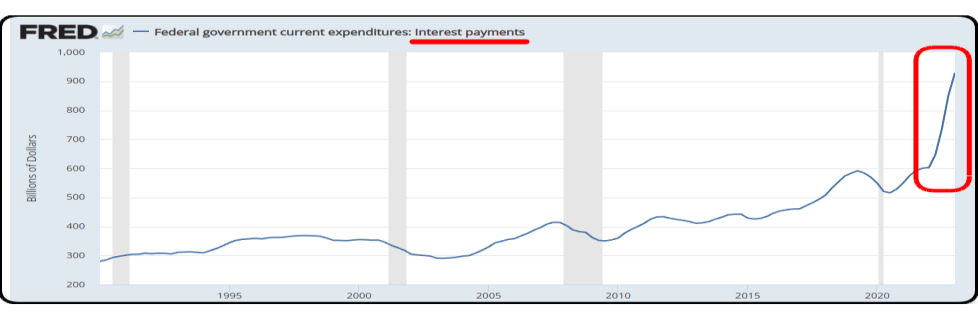

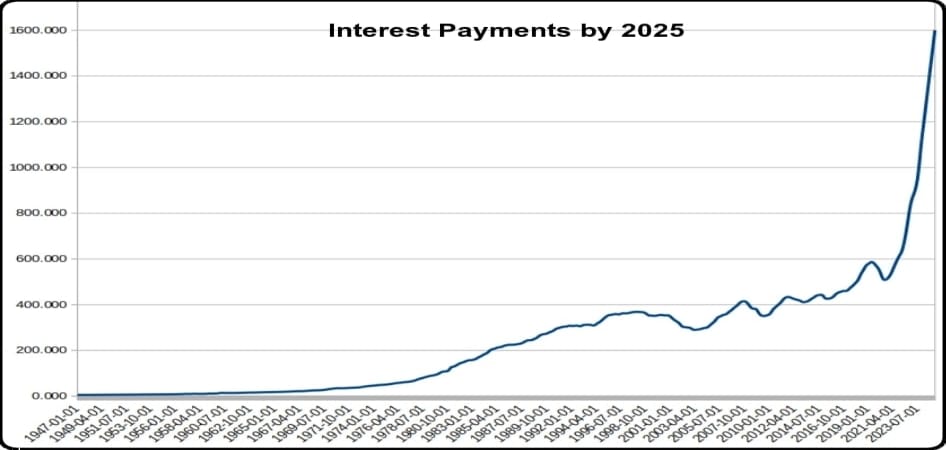

Interest Payments

The current rate of increase in Federal debt interest payments is unsustainable.

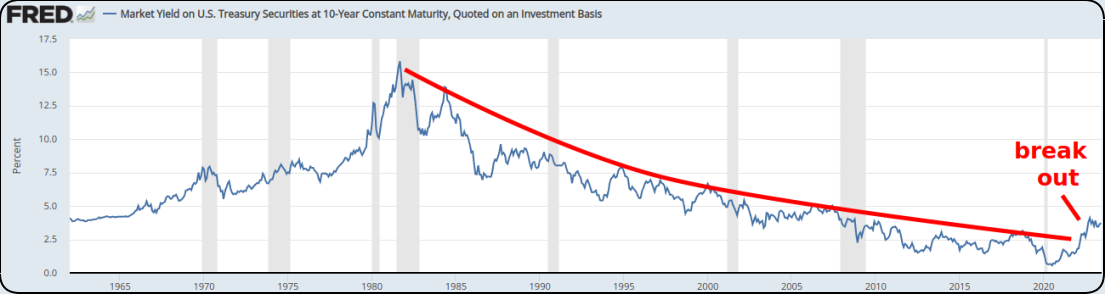

Interest Rates

As debt increases, rates must fall to maintain equilbrium. Interest rates during the credit upcycle (1980 to 2020) have fallen as far as investors will tolerate. Rising rates will be disastrous for the current debt.

BRICS Strategy

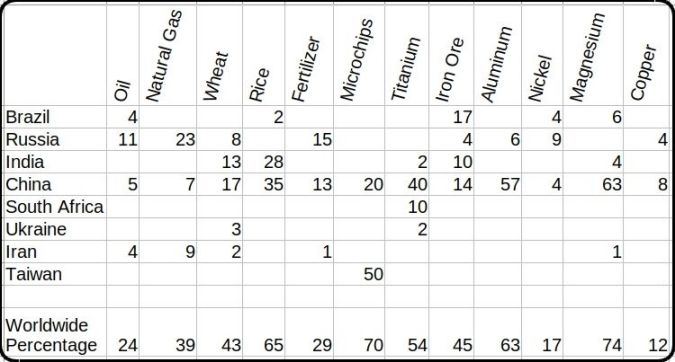

De-dollarization. The BRICS financial system will use its oligopoly power to control commodity prices and bypass the US Dollar. BRIC countries control 1/2 of the world's food supply, 70% of the microchip supply (if China invades Taiwan) and enough energy to control pricing with a partner like Saudi Arabia.

Central Bank Digital Currencies (CBDC)

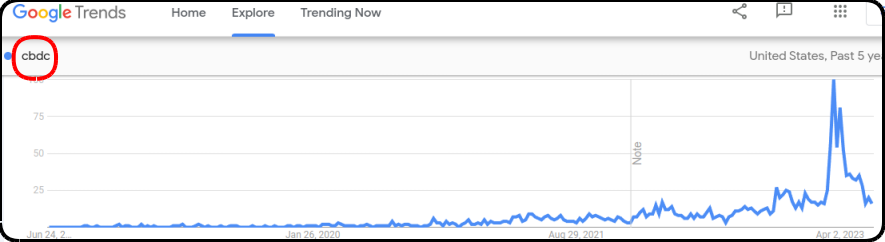

Interest and development in CBDCs accelerated in the past year. CBDCs centralize power and could lead to abuses and political interference in financial transactions.

The Debt Ceiling

The Federal debt ceiling was created in 1917. Its recent suspension is a huge warning sign. The interest payments on the debt are exploding.

Comments