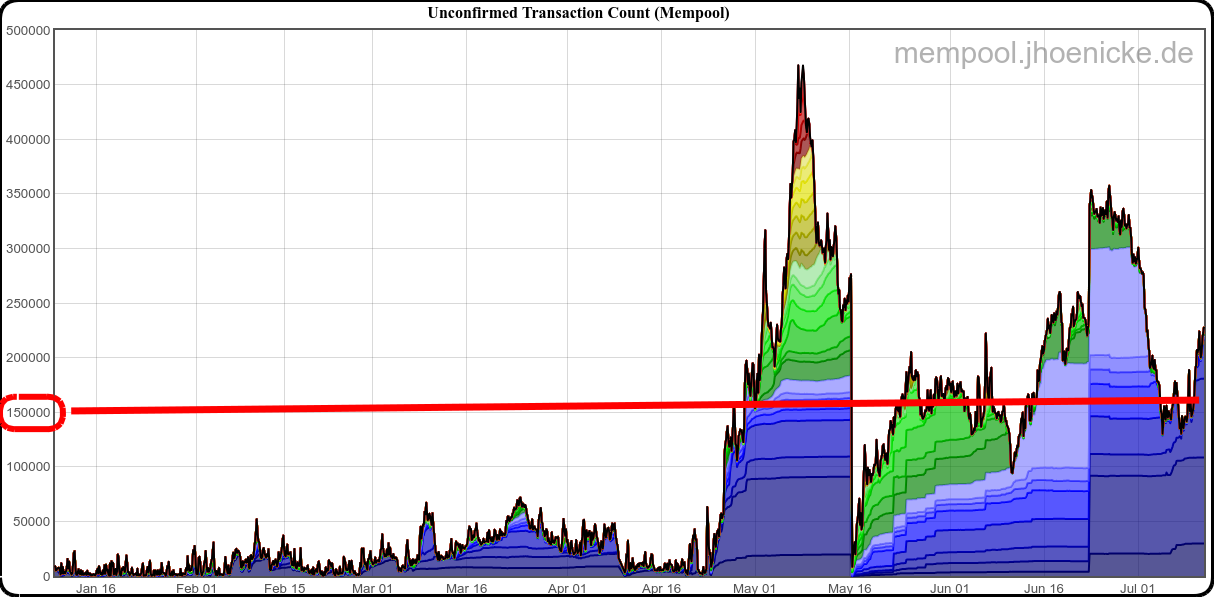

The Bitcoin mempool has had a continuous pool of 150K+ transactions for almost eight weeks.

With a default expiration of 14 days, this means that at least 10K transactions (150K / 14 days) are expiring daily.

10K expirations / 500K daily transactions = 2% loss.

Bitcoin is losing 2% of its transactions. And it's already operating close to its saturation point, so additional traffic will be mostly shunted to the mempool and that 2% loss will rise quickly. 600K daily transactions will probably drop 50K+, or 8% loss rate.

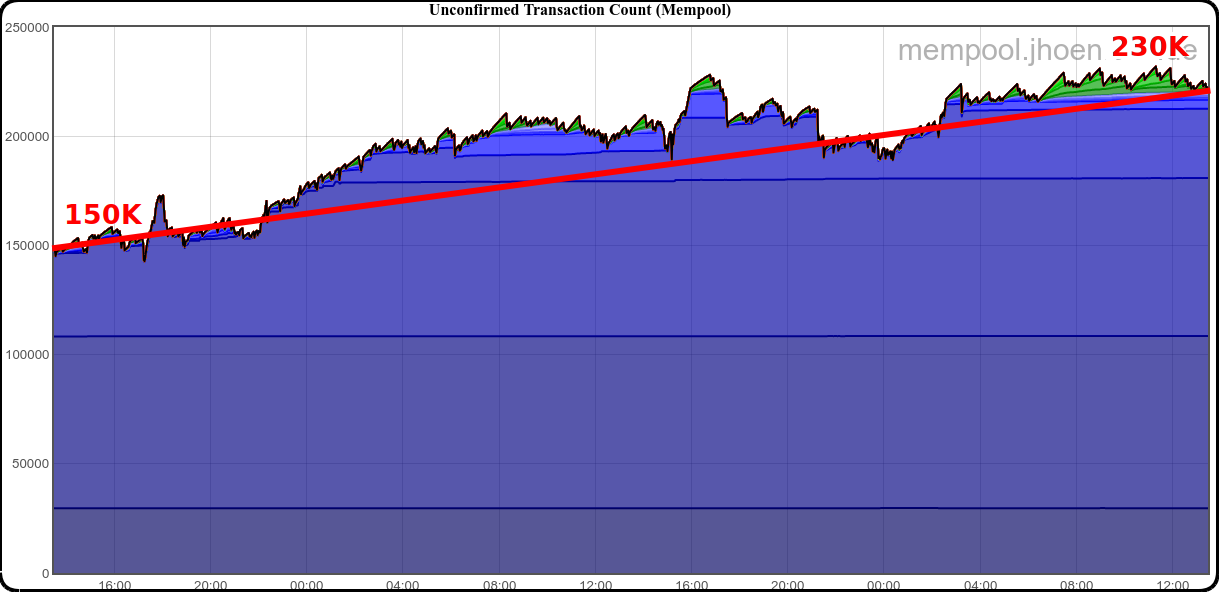

The past two days (July 8th and 9th) were at a 575K-595K rate, look at the rate of mempool increase...

Bitcoin has an intrinsic limit of 7 transactions per second (605K transactions per day). But I guesstimate the true limit is around 540K per day (see above, 585K transactions executed, 40K pushed to mempool).

The simple fix is to raise transaction costs to reduce transaction supply. Why hasn't that happened yet?

And that won't change the miner income halving that's coming in 1st quarter.

Comments