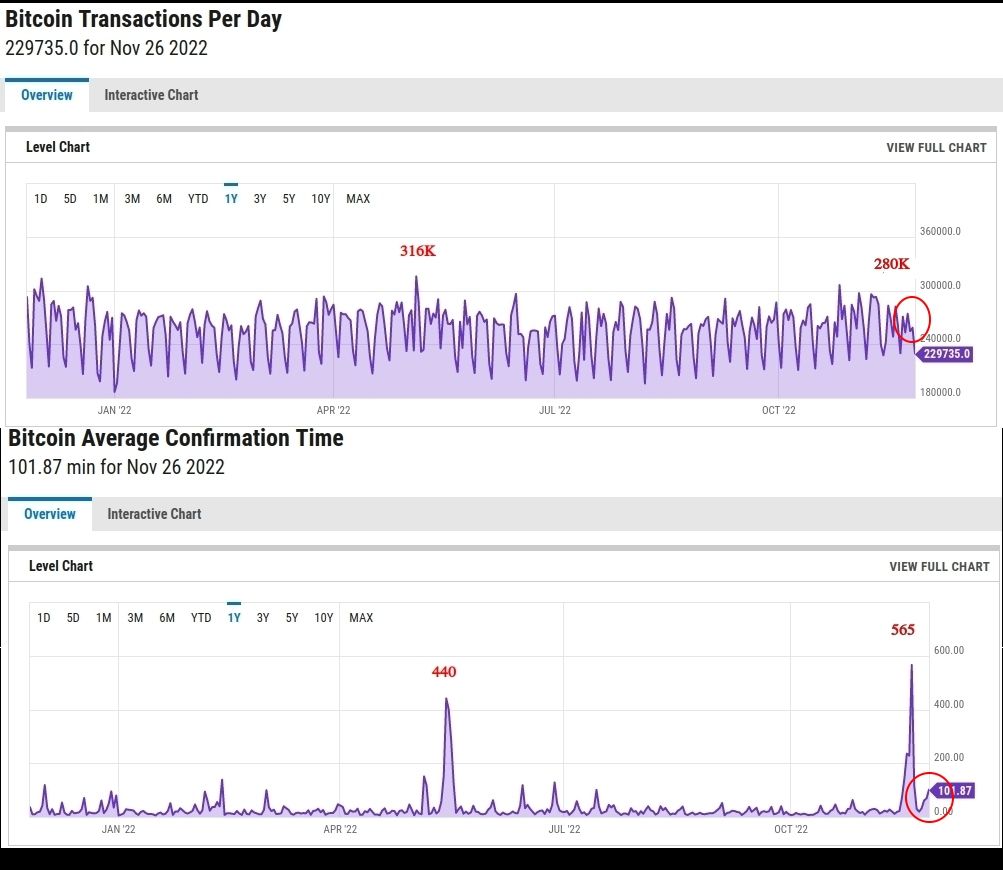

If Bitcoin miners are bankrupting or shutting down, the transaction bandwidth should shrink and process time should increase.

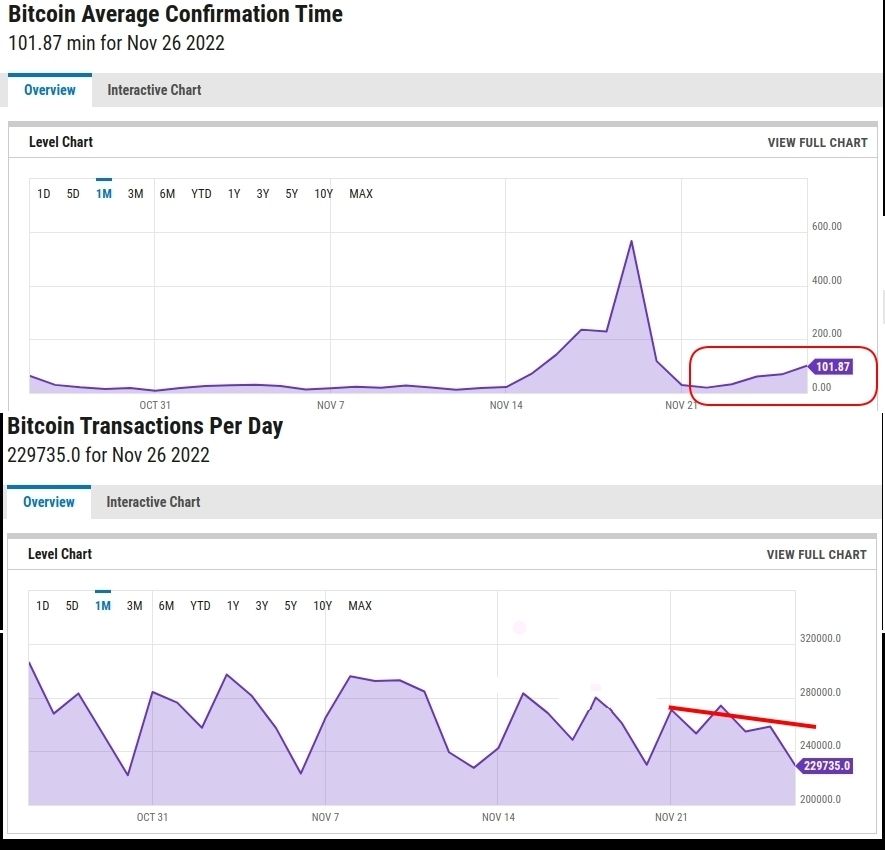

This is a comparison of Bitcoin transactions per day (traffic) to processing time. The May, 2022 spike was the big sell-off when BTC price fell 20% in a few days. The peak of 316K transactions per day had a transaction time of 440 minutes. The FTX debacle in November is similar but... 11% less traffic (280k transactions) had 28% longer transaction time (565 minutes).

Notice the past week. Transaction time rises steadily with fewer transactions.

Most "crypto analysts" still think of Bitcoin as a discrete retail product but as I've said numerous times, it is a network which currently has $16 billion in energy costs. That's constant regardless of the number of miners. But the cost per miner changes. Imagine six men carrying a 600 lb casket, and then one of them stumbles. The other five suddenly carry 120 lbs each instead of 100.

Confirmation time varies too much to be sure yet, but I think it's increasing.

Comments