When I first heard the term "stablecoin", George Soros came immediately to mind. Few people know his early history. In 1992, he crashed the British pound for $1 billion profit by breaking its currency peg in a few days.

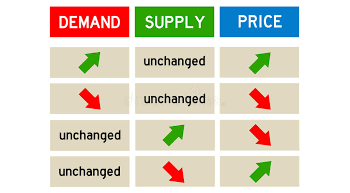

Currency pegs are notoriously difficult to maintain. They are predictable behavior and predictability can be exploited. Look at this Supply & Demand chart...

Since 2019 I've expected Soros-style attacks on crypto-currencies because a stablecoin is a currency peg. To maintain constant price, increased demand is countered with increased supply. Otherwise there are... shortages! Shortages make coin availability unpredictable, create timeouts, unpredictable failures, etc.

Many "algorithmic coins" increase coin supply during a demand spike. The assumption is that surplus coins will eventually get backed by deposits or burned after the spike ends.

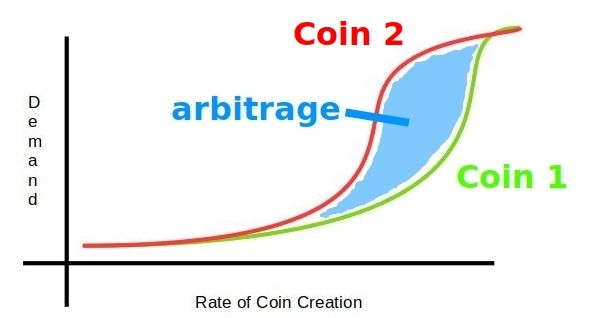

The demand response is a unique time-based function for each coin. In theory, you can arbitrage their differences by submitting a huge buy volume, force coin creation and convert between coins at the right time.

If you don't understand these concepts, you probably shouldn't be using stablecoins.

Possible solutions:

1) Cap incoming demand at 2 or 3% growth rate. Sure, you lose a few customers but you don't lose your platform.

2) Cap rate of coin creation at 2 or 3% per day. Duh. You may get glitchy behavior but you'll know why.

3) Require deposits first to back new coins. That's what banks do. Customers lose a small time value from the delay but it's a one-time cost per new deposit.

Comments