I've expected a miner-based crash for a couple of years. I wasn't sure of its aspect other than that it would be a resource failure. Exponential functions always fail in real-life because they eventually run into resource constraints. In Bitcoin's case, it looks to be from electricity and the end of Moore's Law.

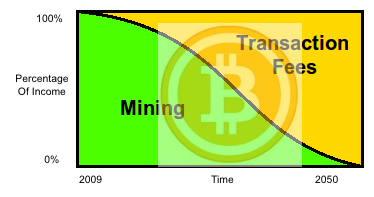

Bitcoin's rebound to $64K surprised me but not this crash. Satoshi's original model was a gradual transition from mining income to transaction fees but Bitcoin's erratic price kept transaction fees from growing. Now there's a sizable infrastructure built around mining, but only 2 million coins left at an exponentially rising cost. So a shakeout in the mining infrastructure is probably in process. The Elon / China / green energy controversy is a simple cover story for an inevitable event.

My prediction is an "emergency meeting" of various Bitcoin parties which increases the "21 million" limit to something like 100 million bitcoins. That would lower costs and keep the infrastructure churning out bitcoins for a few more years. Blockchain purists will be shocked and dismayed but the alternative is a crash-n-burn of the Bitcoin ecosystem.

Comments