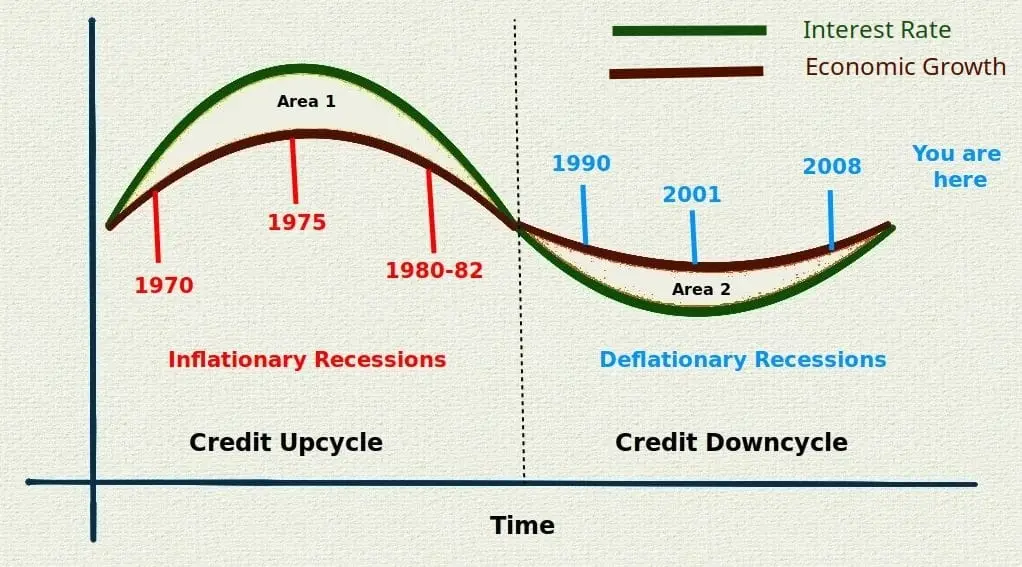

I described the Credit Cycle a year ago, with a prediction that house prices won't crash like the 1990, 2001 and 2008 deflationary (downcycle) recessions. Seventy percent of Americans are under 55 years old and never experienced the 1970, 1975, 1980-82 inflationary (upcycle) recessions when house prices didn't collapse, so 90% of investors expect a crash.

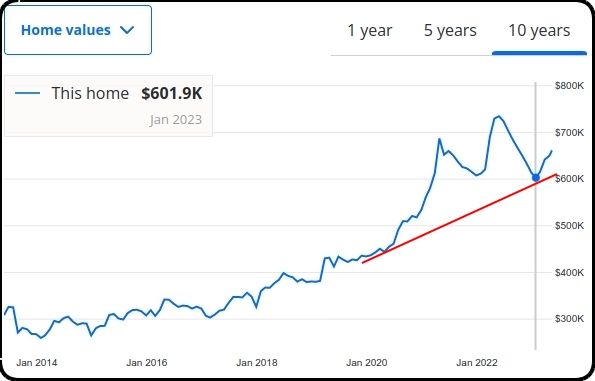

I have two properties in Idaho and Washington that lost value in 2022. Let's check in on them...

Prices bottomed in Jan, 2023 for both. One house rose 8.1% this year, the other rose 9.6%, far above the average annual appreciation of 4-5%. Notice both bottoms bounced off base trend lines, a strong indication of another top ahead, pretty much what I've expected for the past year.

I'm calling this a prediction win for now. Both houses are within 11% of their all-time highs and trending to new highs.

Depreciating cash is seeking physical asset form, just like the 1970s, and global de-dollarization will probably feed this trend for several years.

Comments