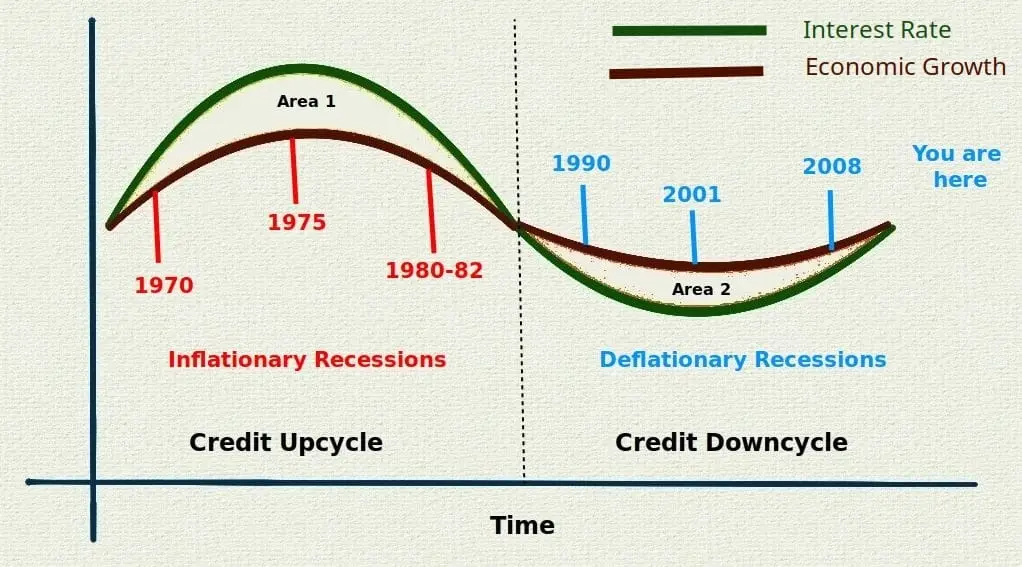

In 1991, I read a Barron's article by Ray Dalio (founder of Bridgewater Associates, net worth of $22 billion) about the credit cycle (Kondratiev wave, debt cycle, etc) and it's been in my mind ever since. Today I read an engaging article by Brandon Smith similar to my own analysis of the past twenty years.

During the upcycle, investors demand interest rates higher than real economic growth. For instance, during the 1970s, interest rates were as high as 20% but economic growth is generally a stable 3% to 6%. This "credibility gap" between reality and paper money is "Area 1" in this graph.

In Keynesian equilibrium, the gap resolves during the downcycle, when real rates fall below the rate of growth and "Area 2" cancels out "Area 1".

The real inflation rate today is probably around 20%. The Federal Reserve won't ever admit it but that rate is not a mistake or misjudgement. They're deliberately burning debt to re-establish equilibrium. I've expected the current environment for perhaps ten years, a defacto devaluation of debt through years of 10%+ inflation, with interest rates below 10%.

There are now tens of millions of mortgages at 3% to 6% rates and at a yearly 10-20% inflation rate, those mortgages become income generators for borrowers by an indirect and lengthy process of home equity. This might be why Blackwater has been buying up residential homes. Effectively, the real growth rate would now exceed the true interest rate which is negative for lenders.

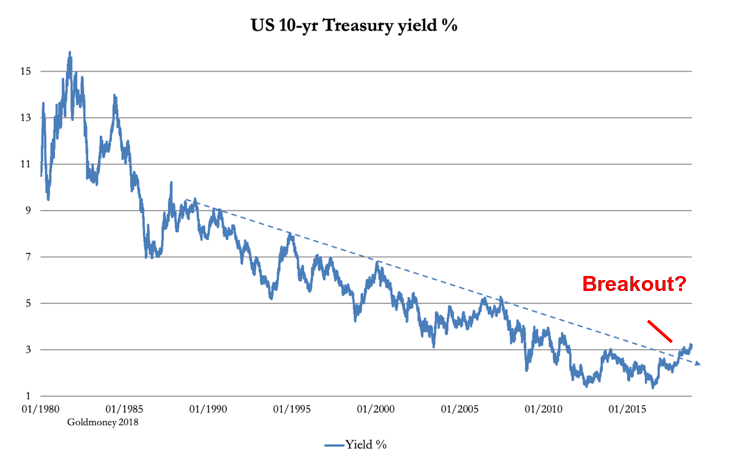

This is interest rates during the credit upcycle (1980 to 2020). As debt increases, rates must fall to maintain equilbrium. The equation the Federal Reserve is working from:

K = economic growth (assume a constant of 4-5%)

D = total debt

I = average interest rate

K = D x I gives us our graph

The only way to maintain rising debt is through falling interest rates. In theory, an infinite debt could be maintained at an interest rate of zero but there's won't be a lot of investors who give their money away for free.

Comments