Lots of hype and enthusiasm about Bitcoin this month.

Let's review a few facts, though.

* Miners still losing around $2.5 billion annually right now.

income: $97K x 165k coins = $16 billion

energy cost: 185 terawatts @ $0.10/kwatt = $18.5 billion

net miner loss: $2.5 billion

* Bitcoin still has a maximum sustainable rate of around 550K transactions per day. It's gonna be really hard to turn that into a sustainable currency.

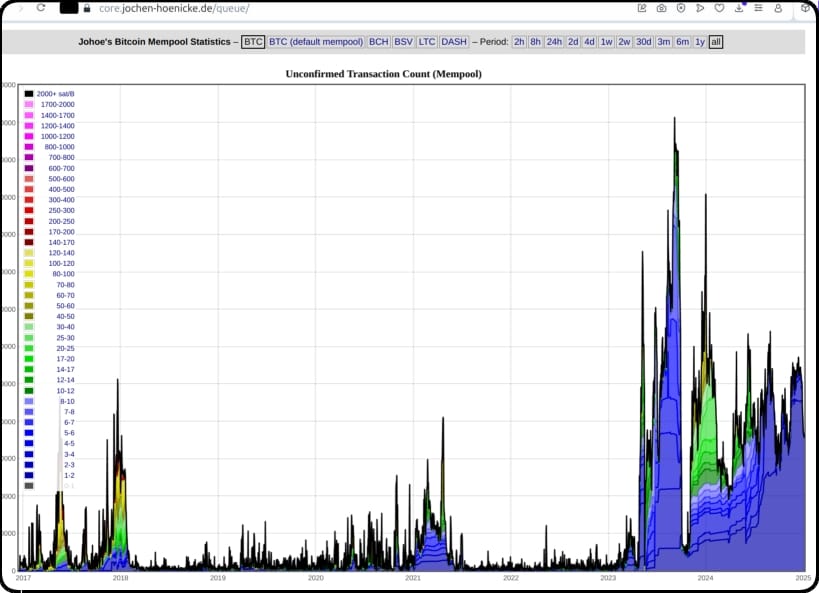

* Bitcoin still dropping at least 1% of transactions with a permanent queue of 175,000 transactions.

Now look at the next coin halving in 2028.

One year ago, Bitcoin energy consumption was 150 terawatts.

As of today, it's around 185 terawatts.

The past five years:

Jan 2020: 71 terawatts

Jan 2021: 85 terawatts

Jan 2022: 96 terawatts

Jan 2023: 80 terawatts

Jan 2024: 155 terawatts

Jan 2025: 185 terawatts

An average increase of 25% per year.

Extrapolate an annual 20% increase up to 2028:

Jan 2026: 222 terawatts

Jan 2027: 266 terawatts

Jan 2028: 320 terawatts

Bitcoin's energy use should reach at least 320 terawatts.

Calculate miner income the day after coin halving...

Assume a bitcoin price of $200K.

income: $200K x 82K coins = $16.4 billion

energy cost: 320 terawatts @ $0.11/kwatt = $35.2 billion

net miner loss: $18.8 billion

Did you think a $4 billion loss in 2022 was bad?

Assume a $300K price...

income: $300K x 82K coins = $24.6 billion

energy cost: 320 terawatts @ $0.11/kwatt = $35.2 billion

net miner loss: $10.6 billion

I suspect this current mania is more about tons of government fiat churning the globe in search of safe haven, than it is about the safety and value of Bitcoin. If Blackrock institutionalizes Bitcoin, (consolidates it into a few financial institutions who issue proxy currencies), they can discontinue the mining process and Bitcoin will become... yup...

another central banking scheme.

Oh, well.

Comments