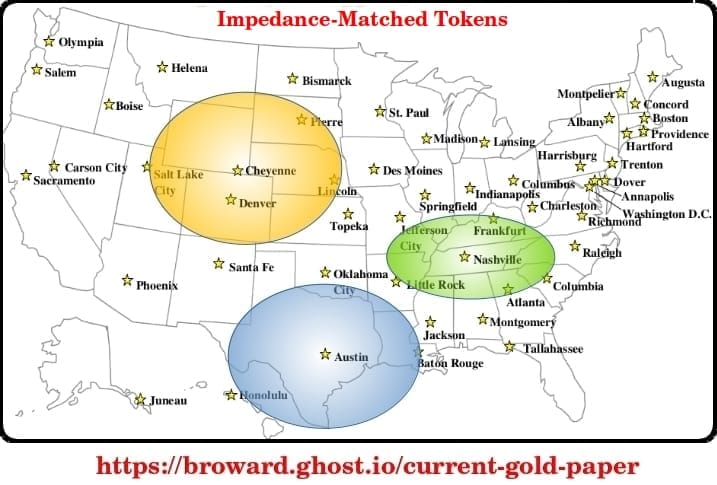

I thought I was done with the Gold Token paper, ver 6. But occasionally I spend a day on research and yesterday I discovered that at least three blue States are pursuing stablecoin platforms (PA, NY, NJ) similar to Wyoming.

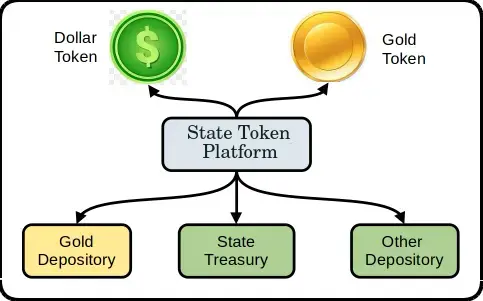

My original mailings were mostly to red States as the Democrat mentality tends to be more inflationary. Backing a State stablecoin with the US dollar is less controversial than gold but can still accomplish a goal of local monetary control and redundancy. It's a simple design change to bind a token to either a physical coin, a treasury dollar or something else in the future like rubles, yen or bitcoin.

It's also a simple design change to bind identity to each token or issue them as a cash equivalent. One of cash's defining attributes is lack of identity. But a well-designed system can support both and perhaps charge a premium for cash tokens.

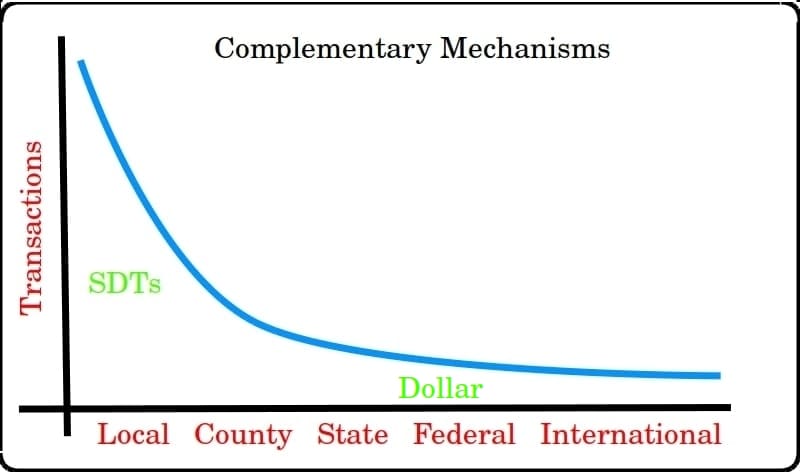

The token platform disassociates the act of a transaction from the underlaying values. In software lingo, it separates the transport layer from the payload (similar to GraphQL vs REST). The same platform could run dollar transactions subject to KYC ("Know Your Customer") and AML ("Anti Money Laundering") Federal laws and gold-based transactions controlled by State laws and international transactions using local pools of foreign currencies.

Last year I researched gold-backed crypto issued by private corporations. Most have failed and I suspect it's because of the pure profit motive. It's too much about instant money and not enough about long-term outcomes. One reason I'm excited about State-based tokens is because of the mentality of State employees and institutional stability. Siriusly.

So I suppose I'll do one more version which includes these ideas.

Comments