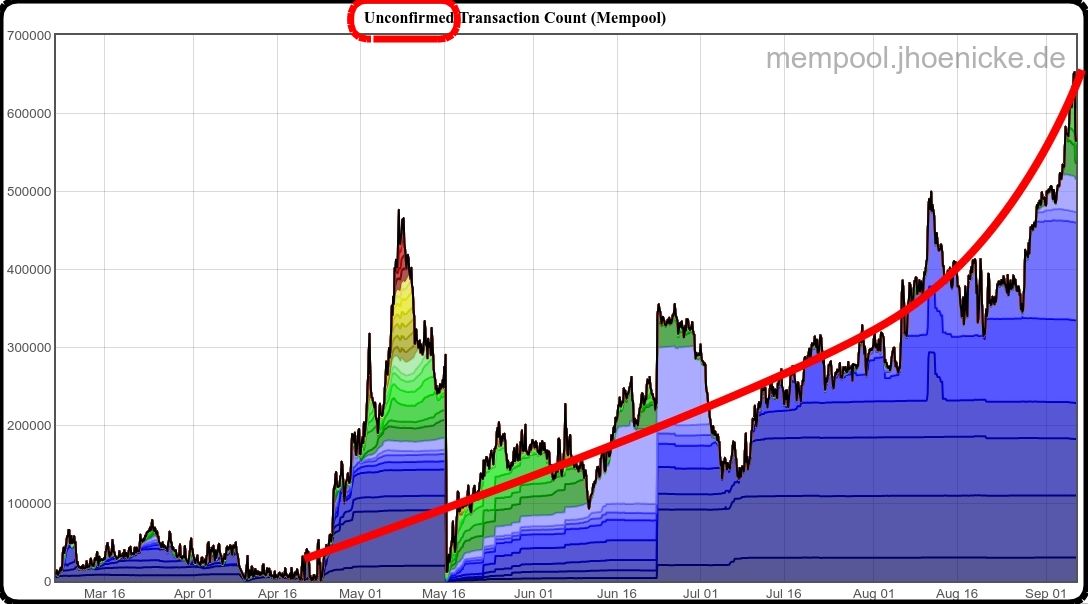

I made this entry a week ago, calculating a 6% transaction loss for Bitcoin, up from 4% on Aug 8th, and 2% in July. Today the mempool made a satisfying leap to 650K, or an 8% transaction loss.

Blackrock is rumored to be buying more miners, probably to keep Bitcoin running during the coin halving in 2024. They face three choices:

1) Lose billions hosting Bitcoin in hopes of a price revival, despite the bandwidth issue. A low percentage bet and reactive strategy.

2) Tweak Bitcoin's framework to last a couple more years. But it's been extensively optimized for many years, what's left to squeeze out?

3) Ditch the consensus and mining algorithms to make it centralized and controlled by Blackrock. This is the likely endgame although it will alienate Bitcoin fanatics and many users.

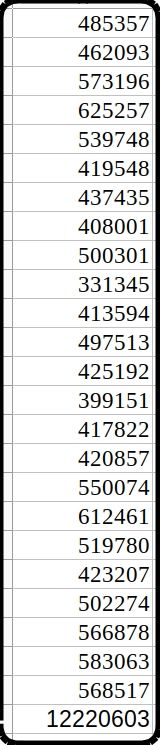

Back in July, I guesstimated that Bitcoin's maximum real throughput was around 540K daily transactions. Today I averaged the past 24 days (1.22 million/24), 509K transactions per day but... it was dropping 4% into the mempool, exceeding bandwidth by 20K+.

The real throughput calculates out to 485K, a 10% drop in five months, most likely from miner dropouts. Remember our pallbearers (miners) example. When one pallbearer (miner) drops out, the other five carry 15% more weight (cost).

Comments