Bitcoin is losing about 3% of its transactions as they expire after 14 days in the mempool. It may be a deliberate cost strategy.

Let's derive the best-cost scenario for a Bitcoin transaction. The network has an intrinsic limit of 600K transactions per day and probably a practical limit of 550K. Possibly less from miner bankruptcies.

The network consumes 140 terawatts per year.

The lowest commercial electricity rate in the United States is $0.08 per kilowatt.

So the minimum cost of a Bitcoin transaction is (140 twatts) x ($0.08/kwatt) / (600K transactions per day) x (365 days) = $51. And probably a more realistic rate of $59.

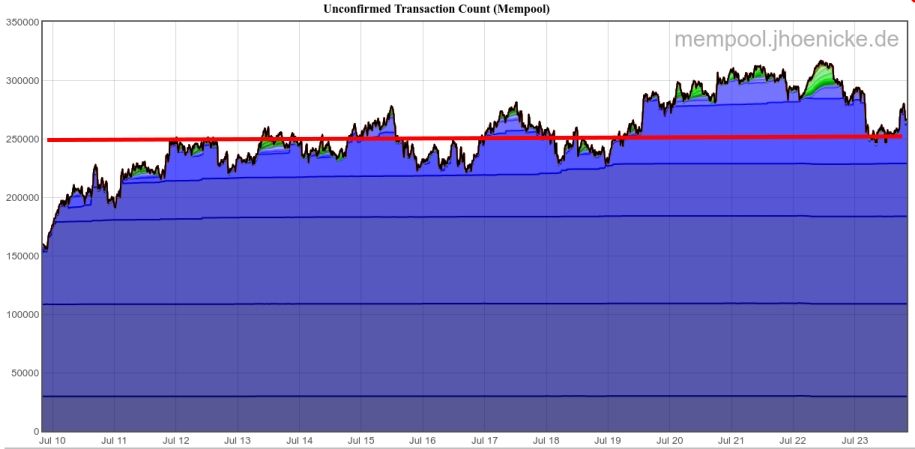

Transactions have expired from the mempool for the past ten weeks, rising from 10K expirations per day to 15K, headed for 18K, or 3% of total transactions (250K expiring over 14 days yields 17.9K daily expirations. 17.9K out of 550K daily transactions is 3.2%).

Comments