Design Issues

The most complex and controversial areas are

- integration of blockchain with inventory system

- cash equivalency, yes or no? (KYC validation)

- key management (like safety deposit box keys)

- appropriate blockchain

State Depositories

In 2009, there were 50 State governments and a handful of crypto-currencies. In 2023, there are 23,000 crypto-currencies but still only 50 State governments. Many currencies are used mostly to buy other crypto-currencies, a sign of a bubble. State depositories can be a significant option for non-inflationary wealth preservation of high-worth organizations and people. There should be funding potential here.

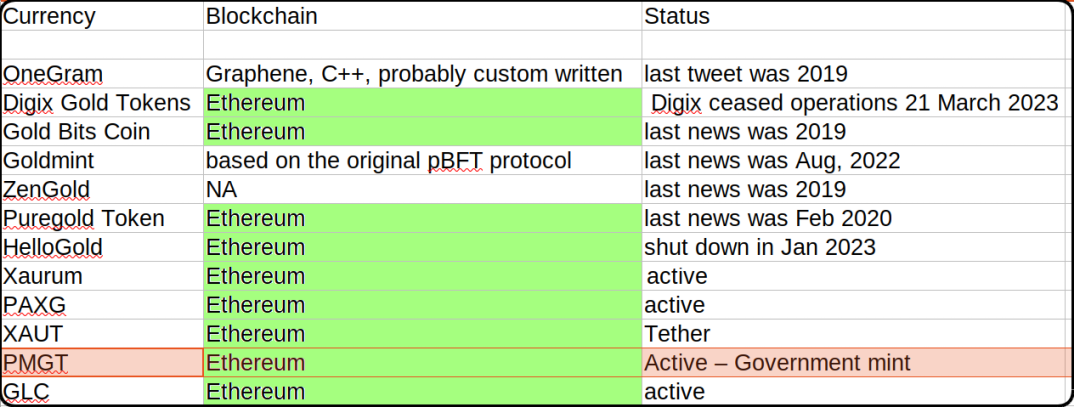

Private Gold-Back Currencies

Many private gold-backed cryptocoins were released since 2018, most based on Ethereum but several blockchains were released since then - Solana, Avalanche, Cardano, etc but a private blockchain is probably better.

Ethereum is probably adequate but not optimal.

Perth Mint Gold Tokens

Perth Mint Gold Tokens are the closest equivalent to our proposed gold-backed digital token. Perth Mint was government-owned and Ethereum-based until their blockchain host discontinued support for legal reasons. This currency should be a primary research item.

Existing Depository

My educated guesses about an existing depository inventory system:

- traditional client-server app

- standard RDBMS for deposit entries

- no external API for remote entries

- no external API for verification of accounts

Token integration would probably require significant modification of the inventory app.

Comments