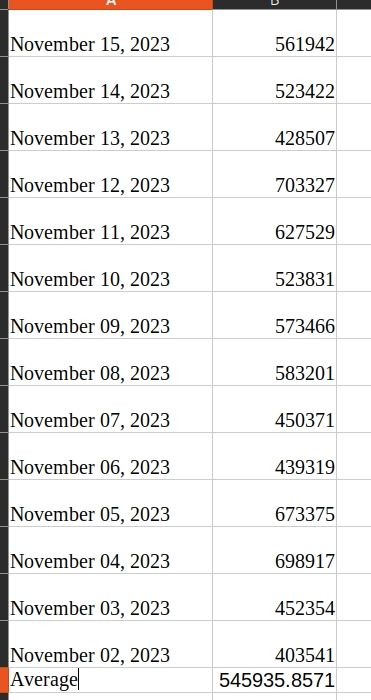

Mempool filling up again, similar to April to September when it peaked around a 6% loss rate. Unconfirmed transactions rose from 40K on Nov 2nd to 353K by the 15th... a net rise of 313K, or 22K per day.

Average daily transaction was 546K in the same period, so we can calculate the sustainable bandwidth at (546K - 22K) = 524K with a 4.2% loss rate. Transactions from Nov 2nd may start expiring around Nov 16th, there's some lag time but you can't exceed capacity for long before packets start dropping.

Blackrock trying to shove this clunker over the ETF finish line to cash out before it goes Full Enron. In retrospect, the sudden traffic drop in October looks suspiciously like a new paint job and engine tune-up. I can't even believe people are still buying it, it's a total herd and bubble mentality.

Comments