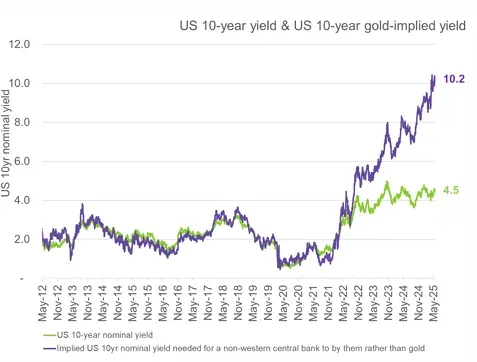

Independent analysis by Goldfix of a Euro analysis (Skandinaviska Enskilda Banken - SAB) on gold vs US Treasury bonds which confirms my suspicions. Biden's war on Russia was a wakeup call for the FedGov fantasy of infinite paper. The SAB assertion is that foreign Treasury buyers are seeking a 5 point risk premium over the bond rate which, for now, is manifesting in gold price. Quite ominous and matches my expectations from two years ago although I'm not sure how SAB quantified this.

The implication is that the diverging graphs will eventually realign, either from a 50% drop in gold price or 10-year Treasuries rising to 10%.

A 10% rate would be a financial atomic bomb. Most Ukraine warmongers don't realize yet that they flew our financial system into a mountain with their obsession about conquering and looting Russia. They still wave little blue/yellow flags to flaunt their "moral superiority", purchased with other people's money.

Extremely unlikely Trump can fix this. If Republicans gain House and Senate seats in 2026, I estimate a 50/50 chance that he dissolves the Federal Reserve with some sort of pro-rated currency conversion.

Comments