Most bankers know this concept but perhaps State legislators not so much...

Maturity Mismatch:

"Banks and other financial institutions often borrow money which... involves short-term liabilities (like checking accounts or overnight loans). They then use these funds to make longer-term loans to individuals and businesses, such as mortgages, auto loans, or business loans"

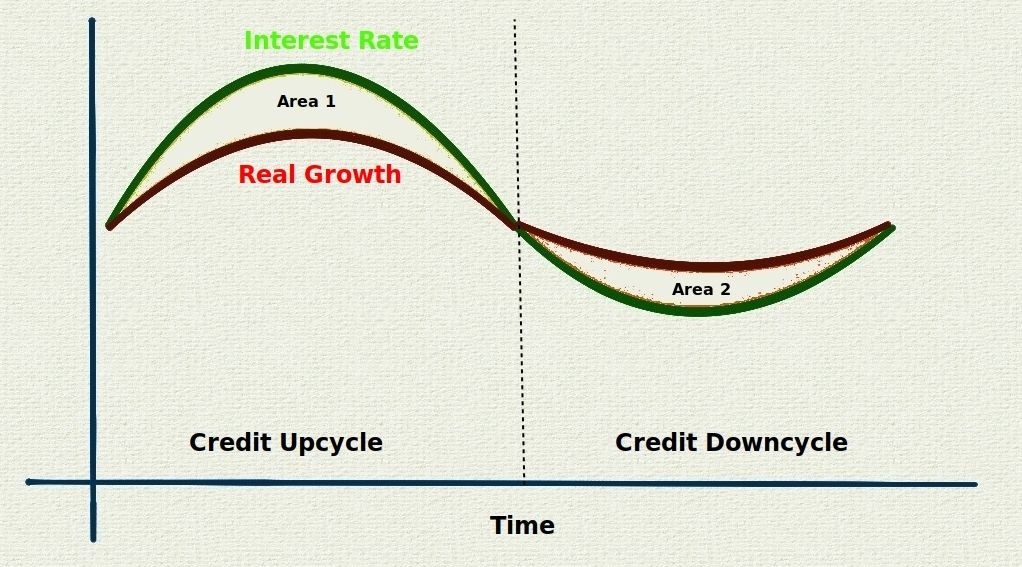

An example: Broward's bank borrows $100K in 1-year Treasuries at 4% interest and then loans it to Hungry Homeowner for 30-years at 7%. Sweet! I'm making a 3% annual profit and donate cash to your election campaign!

Then rates rise and I rollover my 1-year loan at 5%.

Still sweet, I'm profiting 2% per year and still donate a bit.

Then around year 5, short-term rates hit 8%. Yikes, now I'm losing 1% after rollover. Year. After year. Until finally... KA-BOOM and no donation for YOU! Savings and Loan collapse of the 1980s.

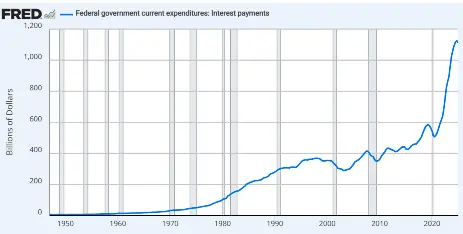

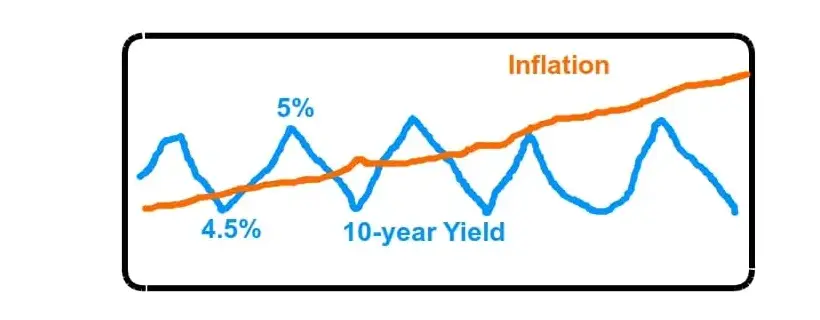

Federal Government is essentially a gigantic Savings and Loan now, with $9 trillion in short-term treasuries to refinance in the next year. They borrowed short (treasuries) and loaned long (Social Security, Medicare, etc). They're struggling to keep the 10-year treasury within a 4% to 5% range to prevent a hyperinflationary feedback loop, although, like Biden's fake inauguration, nobody is supposed to mention this to the common folk.

Keep this in mind when voting on legislation. The banker that funds your campaign today might be tomorrow's Silicon Valley Bank.

Comments