"Some holders of physical precious metals are wary of storing gold within the banking system, even in allocated form, so they prefer to hold gold with entities that are not banks,” Reade said.

ChatGPT quick check on bond defaults by US State governments

"Notable State Defaults (1830s–1840s)

In the 1830s–1840s, a number of states defaulted on their debt, primarily due to speculative investments in infrastructure like canals and railroads.""Since the 1840s:

No state has defaulted on its general obligation bonds."

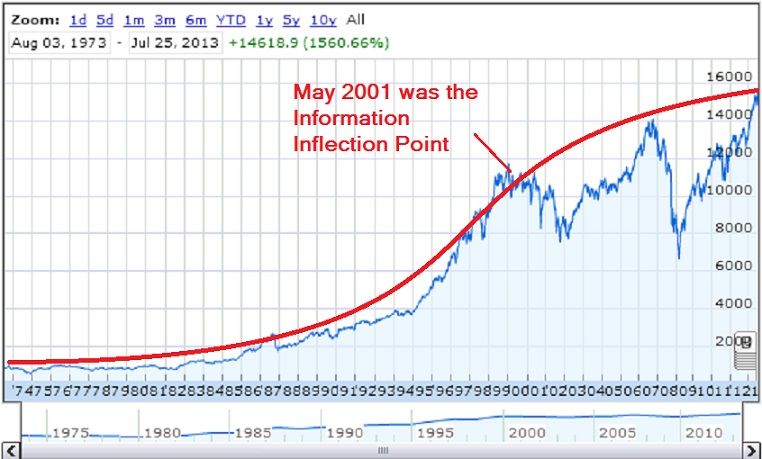

This Age Of Fiat is a bit over fifty years old and founded on two aspects:

- Most nations transitioned to fiat within a small timeframe (1970s) and are devaluing their currencies at more-or-less the same rate.

- The Microchip Age, coincident with the Fiat Age, absorbed monetary increases through rising productivity, which reduced apparent inflation. The Microchip enabled the Age of Fiat.

Now microchip-based productivity is likely peaking while debt-based money creation is increasing. Ergo, sovereign money declines in trustworthiness while stability rises in importance. Our State governments might be better caretakers of "money" in the near future. The BRICS leadership grasps this and probably US leadership, too, but not the US general public.

"Debtors never believe debt matters until they're dangling over a vat of acid".

Comments