I've worked at a couple failing companies and sometimes there's no overt signs until your paycheck bounces. We were hiring at Saleslogix right up until the layoffs and the job offers sent on Thursday were rescinded on Friday. Denial is the nature of people.

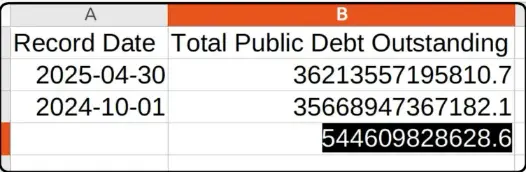

The Federal interest payment graph was finally updated after seven months and somehow the payment magically declined a bit even though an additional $550 billion was added and rates went up.

Debt increased $544 billion.

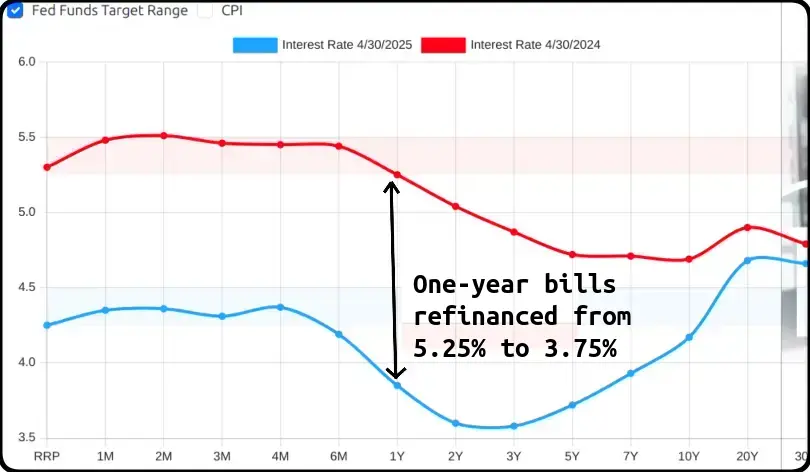

Longer-term rates increased.

Yet total interest payment dropped:

Q3 2024: 1,116.960

Q1 2025: 1,110.853

A significant amount of debt was rolled over in short-term treasuries, 2-year or less. Trump needs T-bill buyers to maintain enough confidence to keep rolling over at a lower rate. Otherwise, the System goes ka-boom.

Oh, well.

Grok>

"Approximately one-third ($9.3 trillion) of the federal debt held by the public is scheduled to mature between April 1, 2025, and March 2026"

Of course, there wouldn't be any Federal checks bouncing. Just more inflation to cover the difference. Many people, particularly Leftists, believe Trump's cutbacks are for revenge and cruelty but what if they're not exactly voluntary? What if the Federal spend is rising faster than Trump's cutbacks?

By the way, did I mention yesterday's restaurant changed their menu last week? The pork chop and steak went up 9%. Today's restaurant said their "price increase" menus will arrive in a few weeks.

Comments