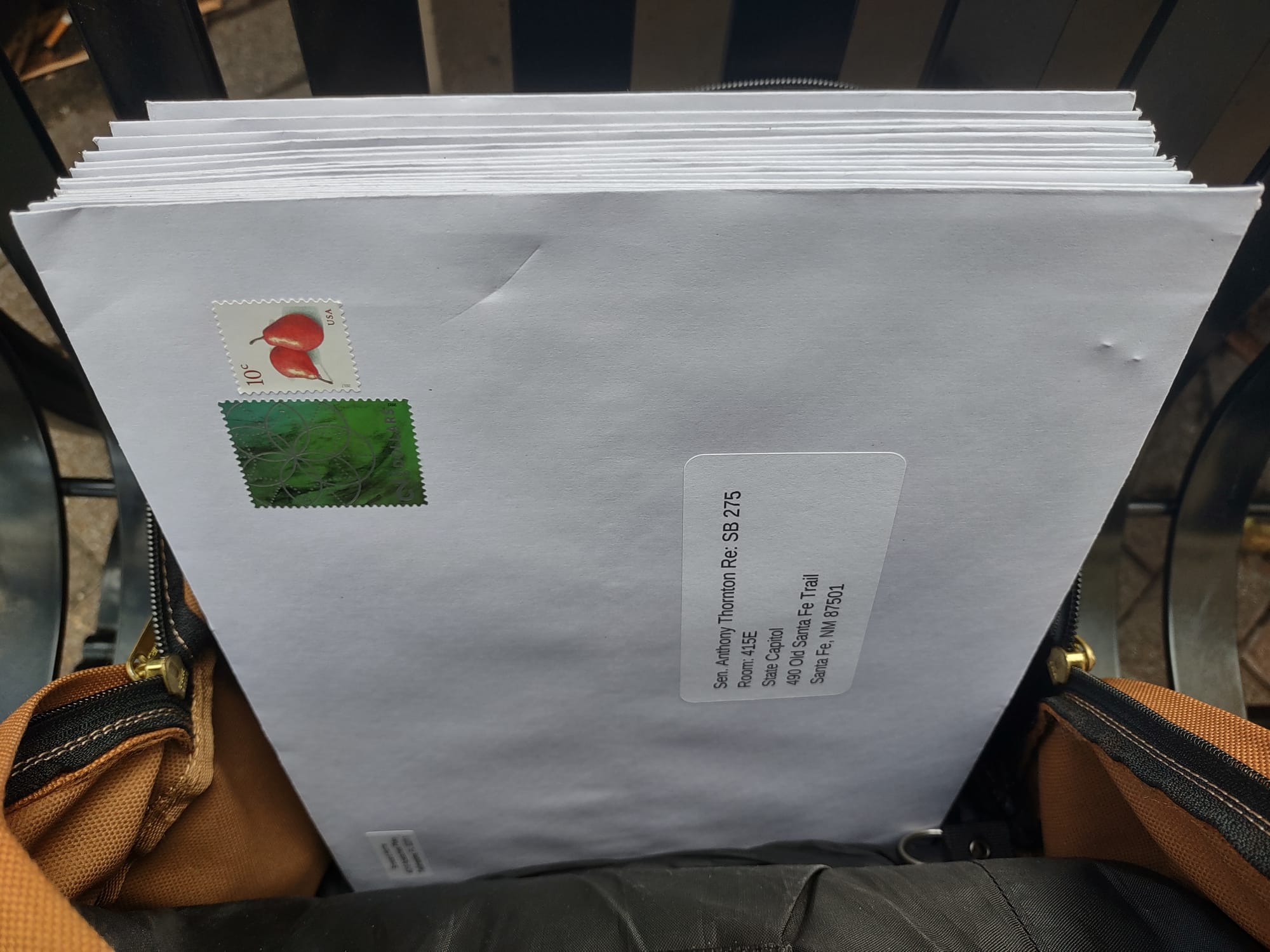

Twenty more copies of the Gold Token White paper sent away today, for a total of 480, 440 towards a target audience of 7,386 State legislators, so 6% penetration so far. About 16-17 gold depository bills were submitted in 2023-2024, almost all were voted down. But in my most optimistic dreams I only hoped for 10 submissions, several are resubmitted for 2025 with at least four also mentioning a State currency. At least one crypto-related bill is submitted daily right now.

I doubt Trump can salvage the current situation even with massive layoffs and privatization, the numbers are too big. The two largest Federal assets, school loans and Federal lands, would only yield $1.6 trillion and $2.7 trillion, leaving a Federal debt of $32 trillion as well as a global fiat system still spewing exponential paper.

My best guess is that Trump does something like England's perpetuities issued between 1853 and 1946 to resolve excessive debt, with some additional twist like a pro-rated conversion. The more Federal debt you own, the less is converted to the new scheme; similar to graduated income tax.

And after one month of Trump's 2nd term, now even Democrats see the downside of centralized, identity-bound money.

.

.

Translation: State-based currencies are still in play.

The saddest Democrats still believe Trump and Musk are motivated by greed but it seems clear to me that they care more about preserving a system which creates value.

Comments