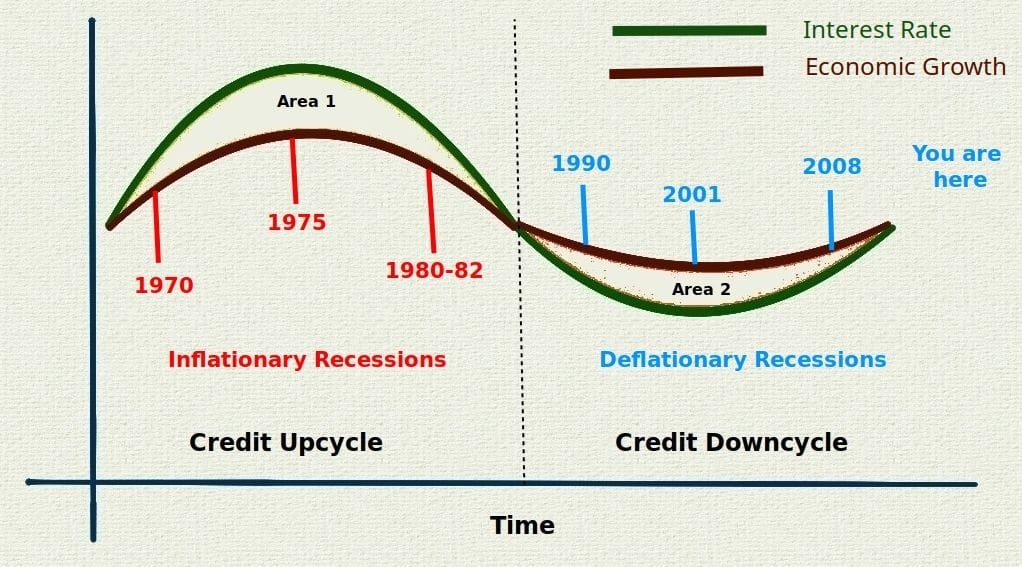

My first exposure to the Credit Cycle was from Ray Dalio when Barron's magazine published his article, "Depression, Not Recession", in 1991. I developed my own interpretation over time and this graph is my original deduction on workweeks and inflationary recessons. I didn't read it in a magazine or article but developed it from data research over a couple of decades:

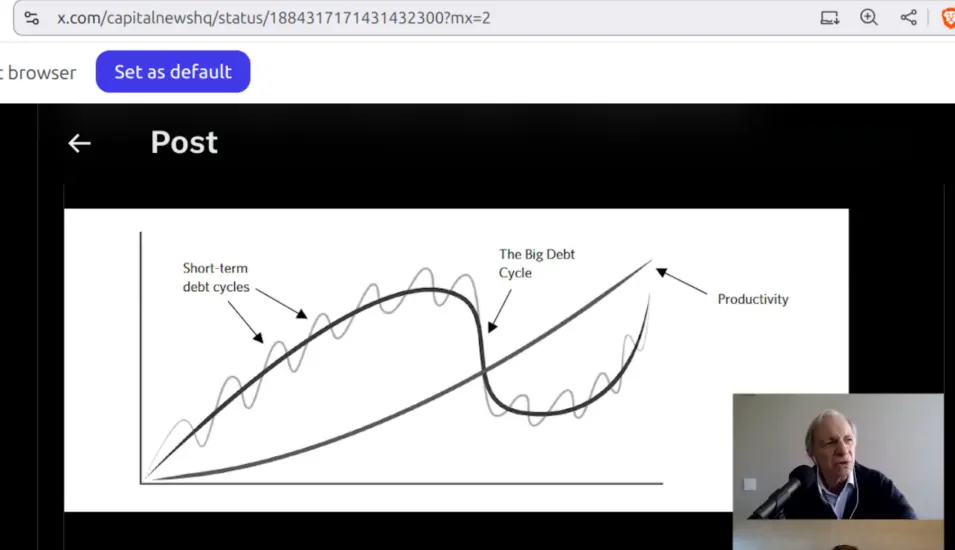

Here's Dalio's latest model from a recent interview:

I gotta say, today I'm feeling pretty validated by The Master.

Dalio overlays the productivity function onto the Credit cycle curve. I interpret productivity through average work week, which is an inverted function. As productivity rises, net amount of work declines proportionally. I'm still waiting for Team Trump to realize they're gonna have to re-write the Federal labor laws for a 28 or 32-hour workweek.

These government make-work jobs exist for a reason.

Comments