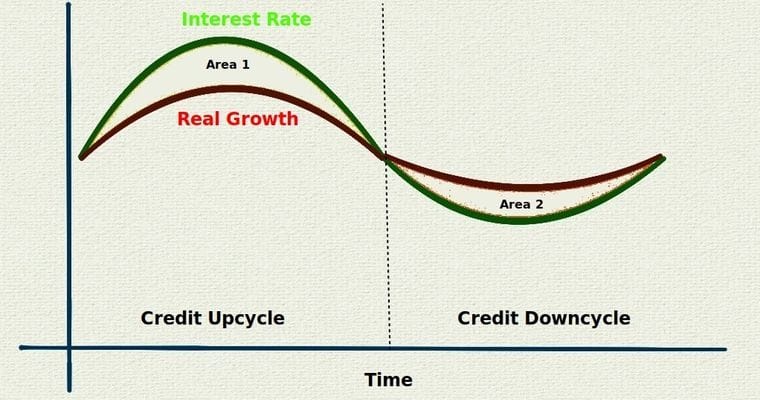

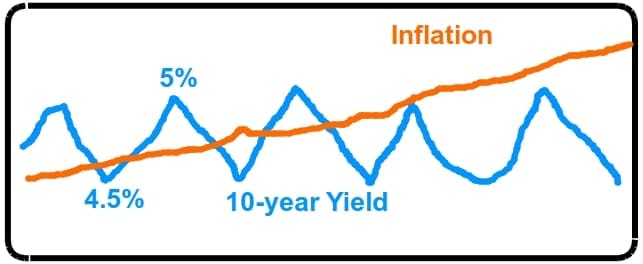

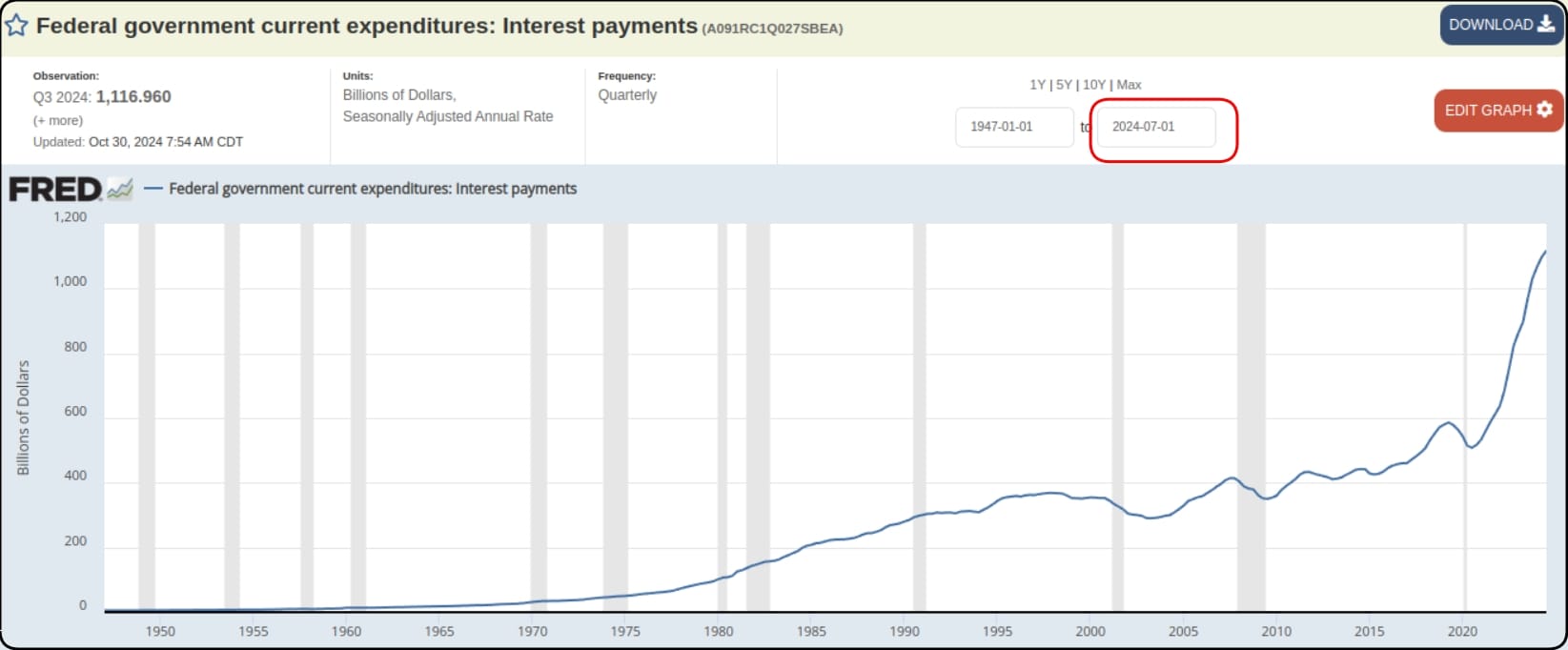

As I suggested back in March, the Fed is probably monetizing the debt to keep the 10-year yield under 5%. I assumed a zigzag range of 4.5 to 5% but it looks wider, probably because their feedback granularity is too coarse. But it's gonna get harder to juggle as the debt grows even faster. They'll keep suckering some money back to refinance at 4 to 5% rate but I expect inflation to exceed that and burn value off the refinanced debt.

The Fed is forcing that gigantor pile of $36 trillion to pay 5% interest while 10% inflation reduces its actual value. Pretty much what I predicted thirty months ago. A tragedy of the commons situation because there's a bunch of billionaires who don't want their money destroyed and think buying the 2024 election can prevent it.

noppity nope nope no.

The hard money versus soft money battle again

Comments