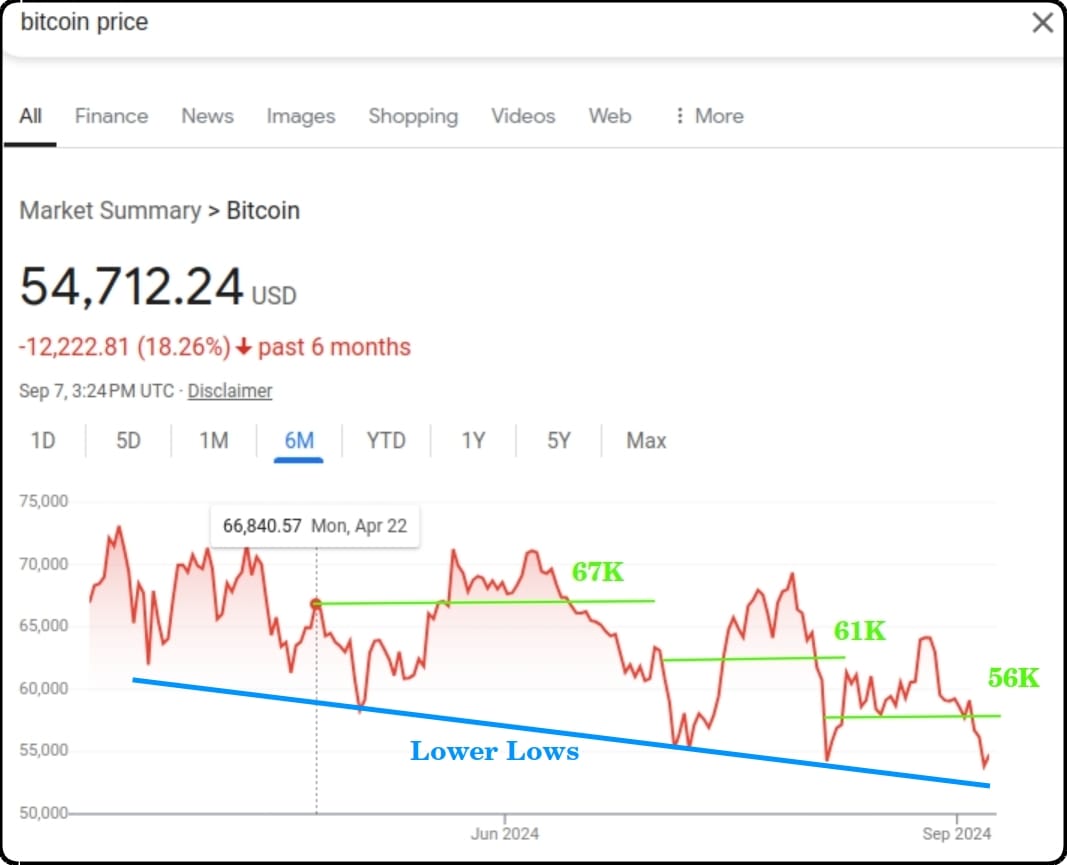

Bitcoin currently at $54,700, the same as when I posted this one month ago. Let's guesstimate miner losses since the April 19th halving.

Miner profits before the halving

income: $70K price x 330K coins = $23.1 billion

cost: 175 terawatts x $0.10 per k/watt = $17.5 billion

profit: $5.6 billion/year or $467 million per month

April 19th to June 19th

income: average $67K price x 165K coins = $11 billion

cost: 155 terawatts x $0.10 per k/watt = $15.5 billion

loss: $4.5 billion/year or = $750 million for two months

June 19th to July 19th

income: average $61K price x 165K coins = $10 billion

cost: 155 terawatts at $0.10 per k/watt = $15.5 billion

loss: $5.5 billion/year or = $460 million for one month

July 19th to now

income: average $56K price x 165K coins = $9.2 billion

cost: 155 terawatts x $0.10 per k/watt = $15.5 billion

loss: $6.3 billion/year or = $780 million for 1.5 months

Net loss since April 19th: $2 billion

Annualized loss right now is around $6 billion.

My prediction from eleven months ago:

"Surviving miners could lose $6 billion in 2024

instead of $4-5 billion. I expect a big selloff

after the coin halving as too many people are

buying on rumor and will sell on the news."

The decompression of Bitcoin price after the Halving was a high percentage bet. It wasn't even as risky as buying a rumor, since the Halving was guaranteed.

Comments