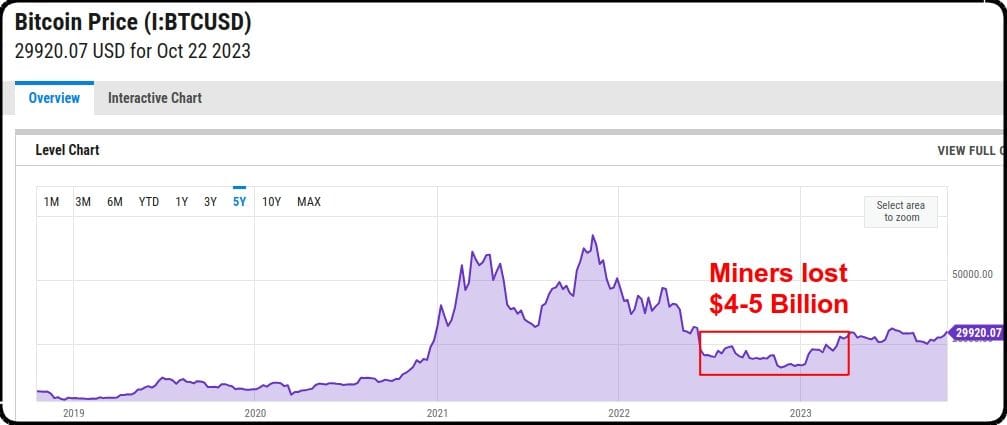

Miners lost $4 to 5 billion during the 2022 Bitcoin bear market and almost half went bankrupt from November 2022 to April 2023.

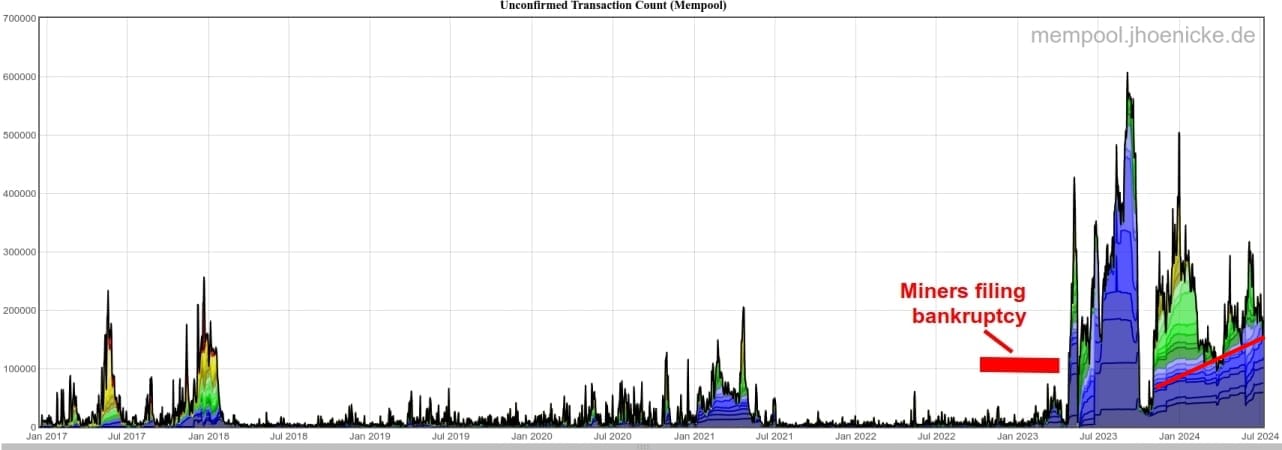

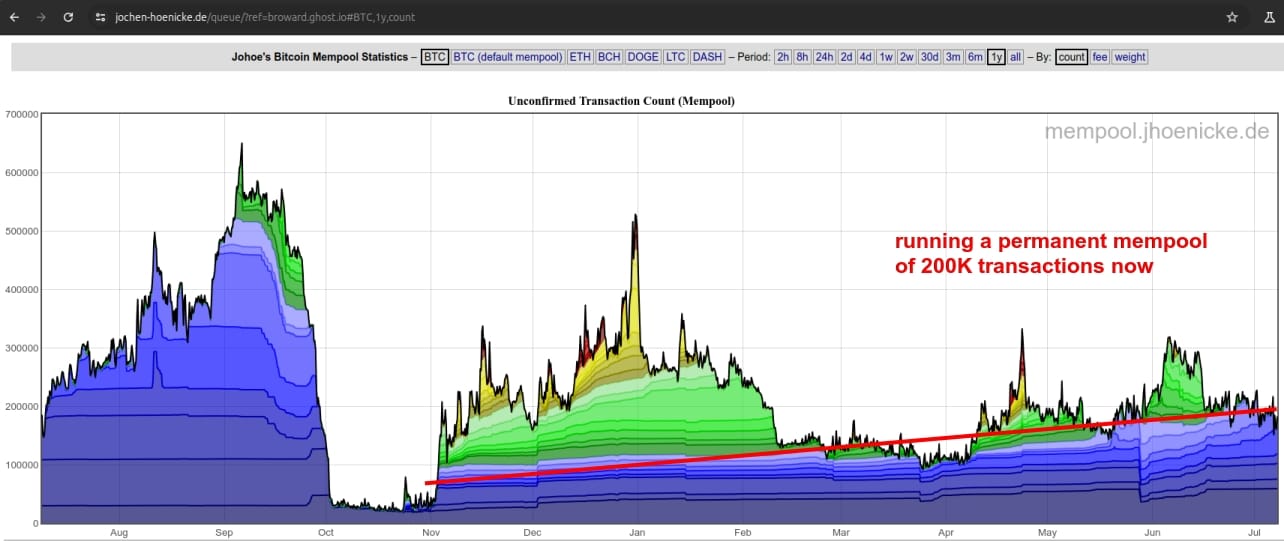

Loss of miners means loss of network bandwidth, which means longer processing time and lower traffic capacity. Bitcoin still hasn't fully recovered and is always running in a saturated state, i.e. over–capacity. A permanent mempool (traffic overflow) of 200K translates into a 1-2% loss rate, roughly the same as email.

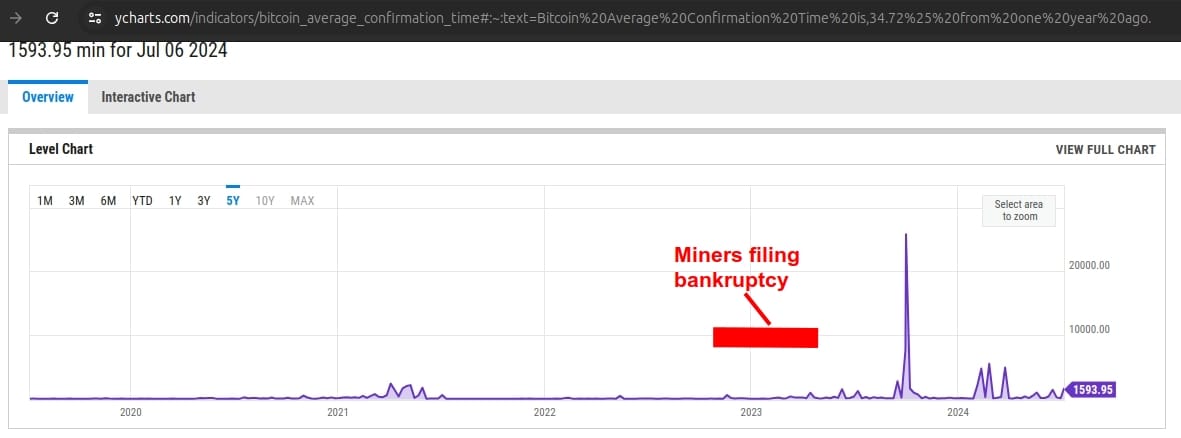

You can also see the damage in Bitcoin's response time, which hasn't recovered to the pre–crash response time.

Bitcoin is currently at $54,700.

Miner income: $54.7K x 165K coins per year = $9 billion

Miner energy cost: 140 terawatts at $0.10 / kwatt = $14 billion

Miners are in the same position again, losing $5 billion per year. Bitcoin would likely have died by early 2024 except for Blackrock spending several billion to prop up bankrupt miners.

Comments