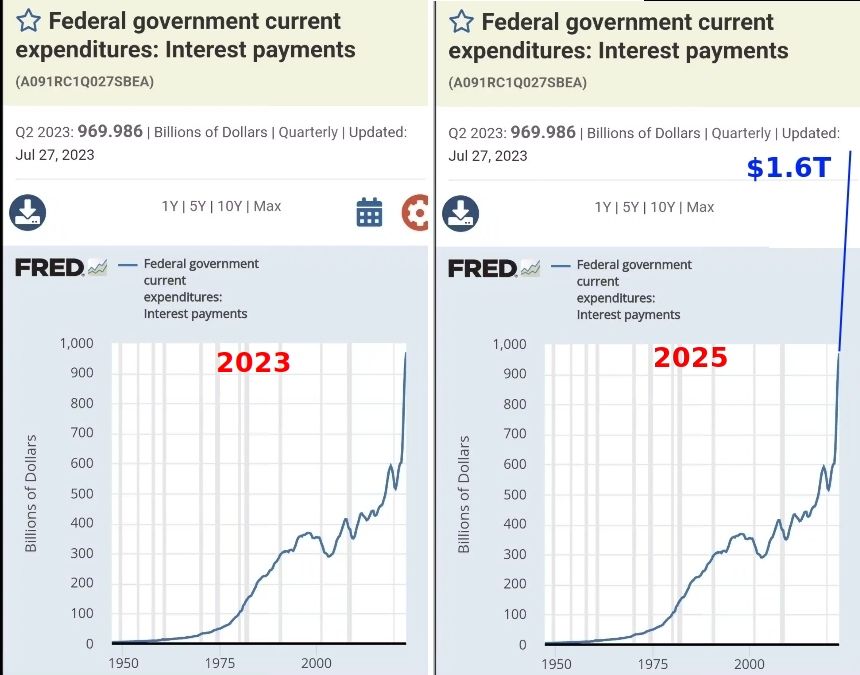

I love this graph. It's so clear that expectations changed drastically after Biden's election..

The right is an extrapolation to 2025, as expiring 1.6% treasuries are refinanced as 4.2% treasuries.

Literally off the chart.

Assuming a stable economy and no nuclear war, the interest payments should inflect in the $1.4 to $1.6 trillion range. The Federal government will have a cashflow problem before that, though. They're already jettisoning line items which the public won't immediately notice, like refilling the Strategic Petroleum Reserve.

My guess is they'll quietly print like the Federal Reserve has with the Bank Term Funding Program, pumping short-term loans into the banking system since March to prevent a systemic collapse; (most Americans are blissfully unaware that over 200 banks are insolvent). Like the PPP program during COVID, these loans will probably never be paid back so they're a cash injection and conveniently excluded from inflation calculations.

Comments