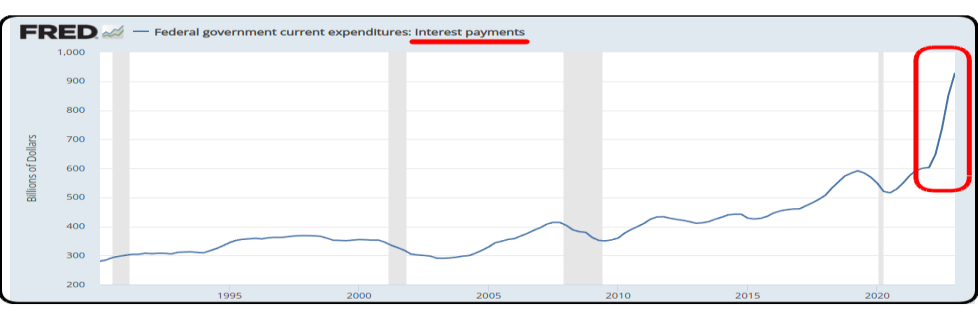

We can guesstimate the interest payments on the Federal debt by Jan, 2025. Most Federal debt shifted into short-term bills during Clinton's administration to create the illusion of a budget surplus and that's held true for most of the recent past. The average interest rate was 1.60% in 2021, and total payment was $575 billion.

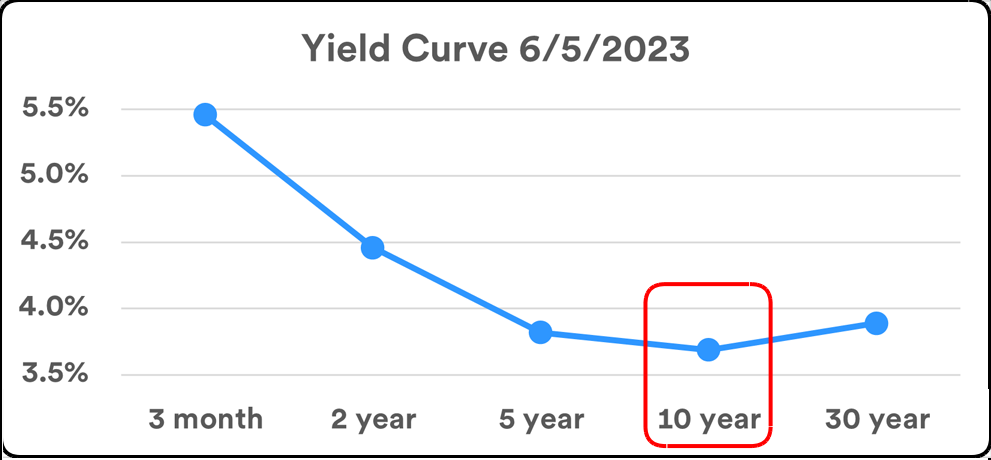

Existing debt is mostly in short-term bills, the optimum refinance right now is 10 year Treasury at 3.7%, or 2.3X higher interest:

$575B x 2.3 = $1.3 trillion.

And the debt increased at least 10% since 2021, so

$1.3 trillion x 110% = $1.4 trillion.

One third of the "$4 trillion budget" will go to interest payments, haha. No wonder there's no budget ceiling, hey? It should be an interesting sixteen months.

Comments