Last December I described how the Bitcoin network might deteriorate as miners disappear. Bitcoin absorbed significant money last month from the banking collapse, how has that affected my scenario?

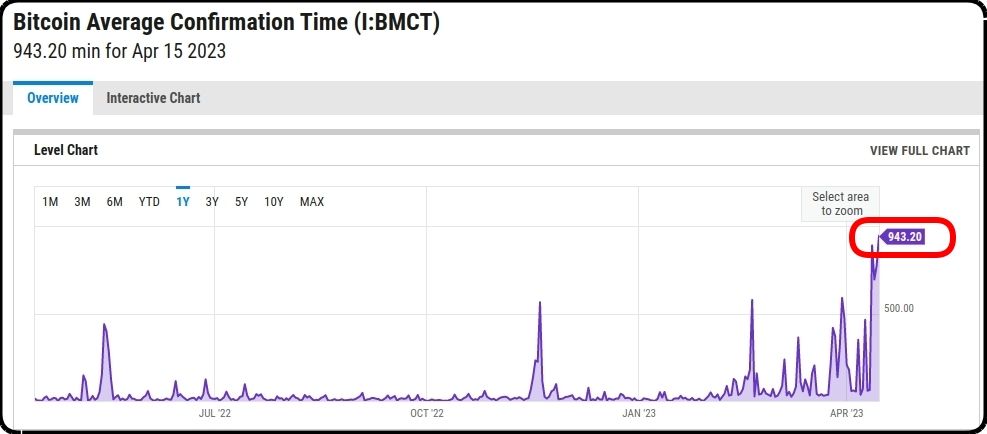

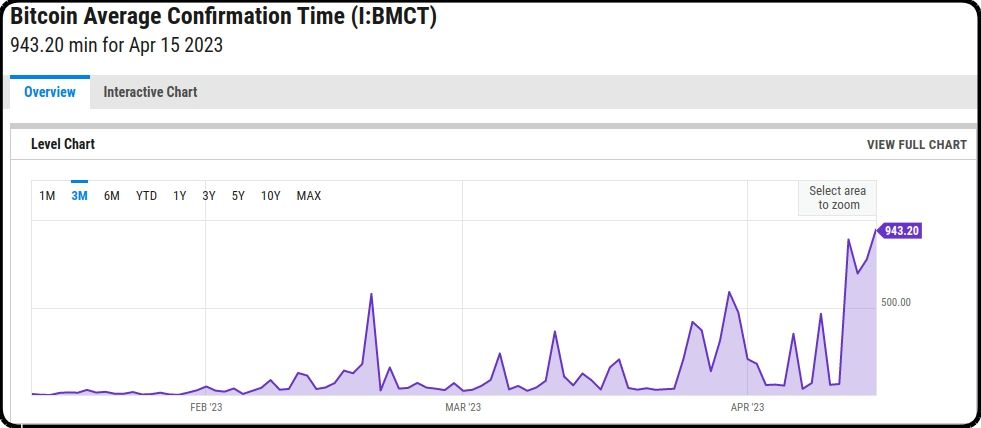

At least 30% of miners went bankrupt in the past six months, so I guesstimate about 50% are gone. Check out recent network performance.

Oh, my. Confirmation time hit 943 minutes this week, which aligns with my prediction in December. How are the miners doing at a $30k price?

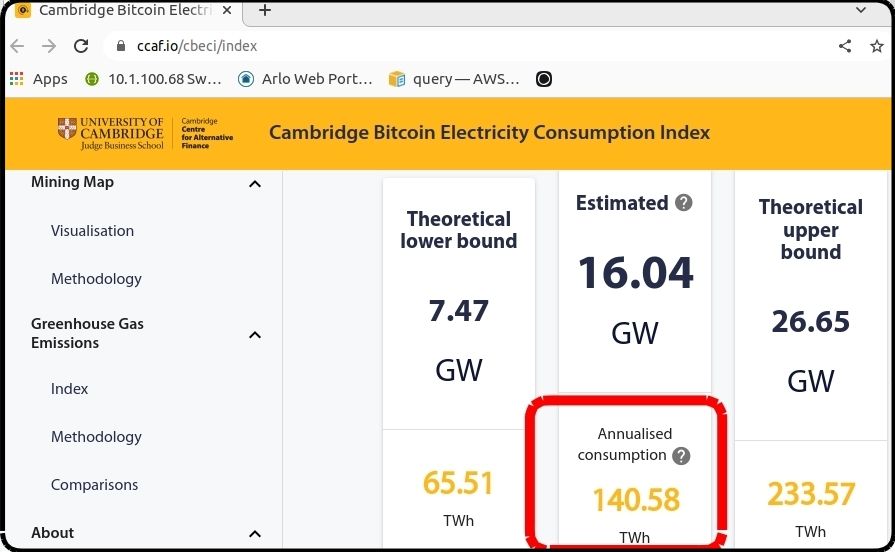

Bitcoin energy consumption rose from 118 terawatts to 140 terawatts, a 19% increase in the past six weeks.

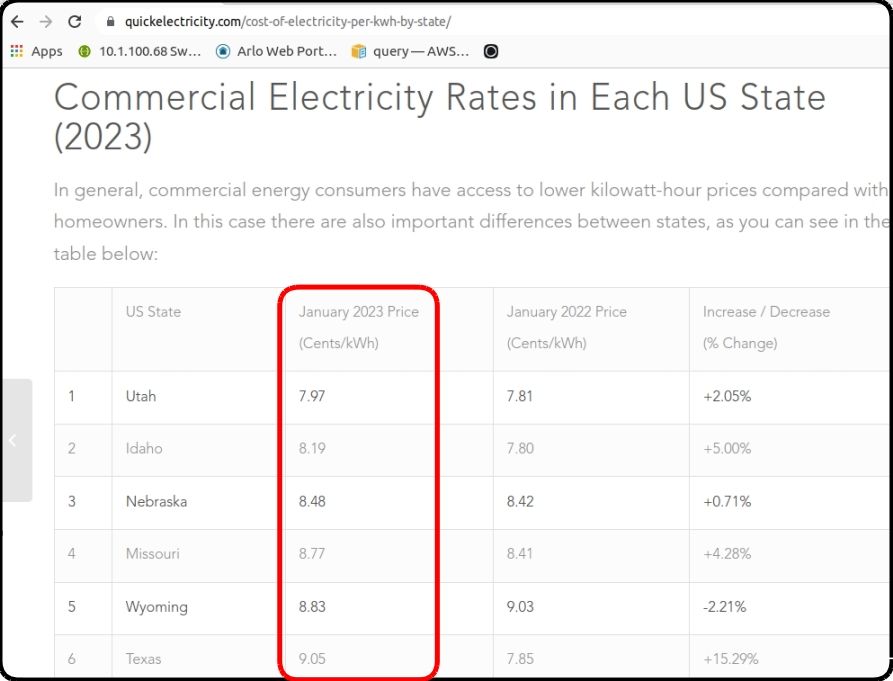

Let's check energy prices... commercial rates in 2023 ranged from a low of $0.08 to $0.22 in continental US.

Roughly 1/3rd of miners are in North America, 1/3rd in Europe, and 1/3rd in Russia/Asia. Energy costs are highest in Europe and lowest in Russia so we'll guesstimate they average out close to the $0.09 per kwatt of the United States.

- Miner income: 330K coins X $30,500 = $10 billion

- Miner cost: 140 terawatts x $0.09/kwatt = $12.6 billion

Oh, my, again. Even at a price of $30K, the network is probably still cash negative.

Fast forward to the 1st quarter of 2024. Assume Bitcoin price rises to $50K, energy usage rises to 160 terawatts and energy costs rise to $0.10 / kwatt. But... remember... available bitcoins halve to 165,000 per year.

- Miner income: 165K coins X $50,000 = $8.25 billion

- Miner cost: 160 terawatts x $0.10/kwatt = $16 billion

A projected loss of $7.75 billion. The annual loss in 2022 was $5-6 billion. In 2024, Bitcoin will probably be in worse fiscal condition with more miners going bankrupt. Watch the transaction confirmation rate. Systemic failures often don't give advance warning but I expect another exodus of miners in early 2024 if price doesn't break above $50K.

Comments