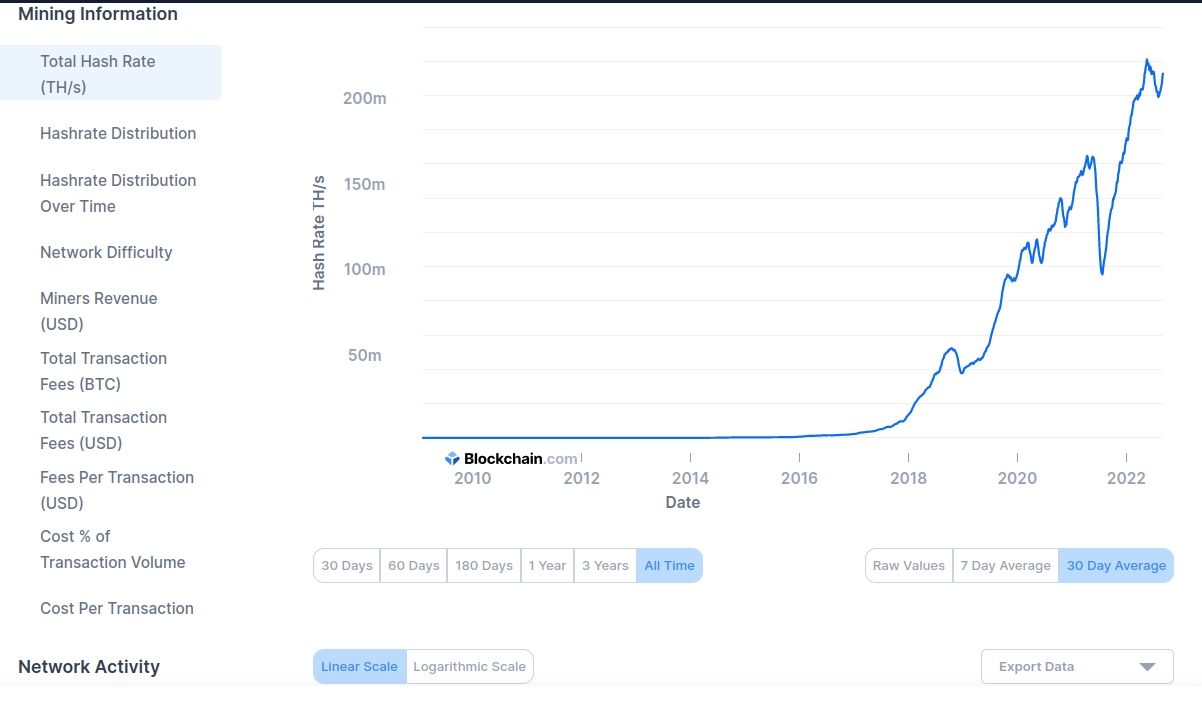

Check Bitcoin's hash rate (net computing power) in a linear graph...

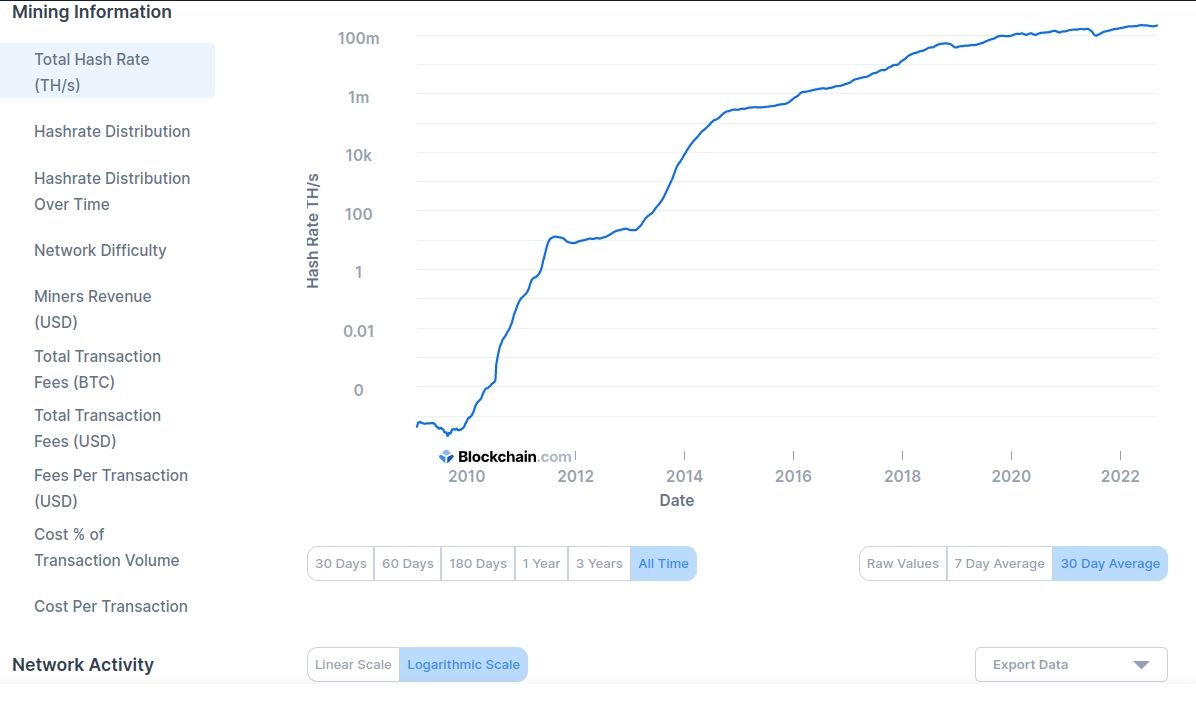

Now in a logarithmic graph...

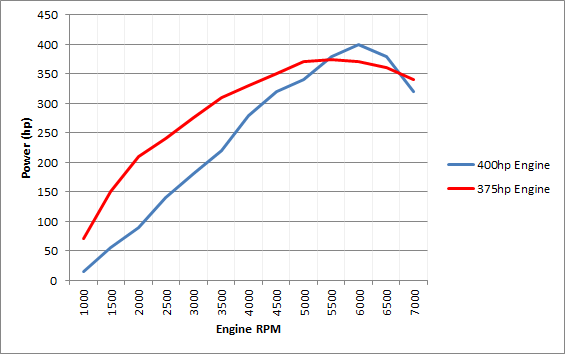

It's topped out, like the power curve of a 4-cylinder engine. Maxxing out engine RPM paradoxically produces less power.

A couple explanations... it could be profitability declining to zero. As profitability falls, there less incentive to buy hardware and a flatline implies no future profit.

It might be an intrinsic bottleneck in physical infrastructure, like it is for a gas engine. A physical limit has been reached.

Either way, it sets a limit on Bitcoin's future.

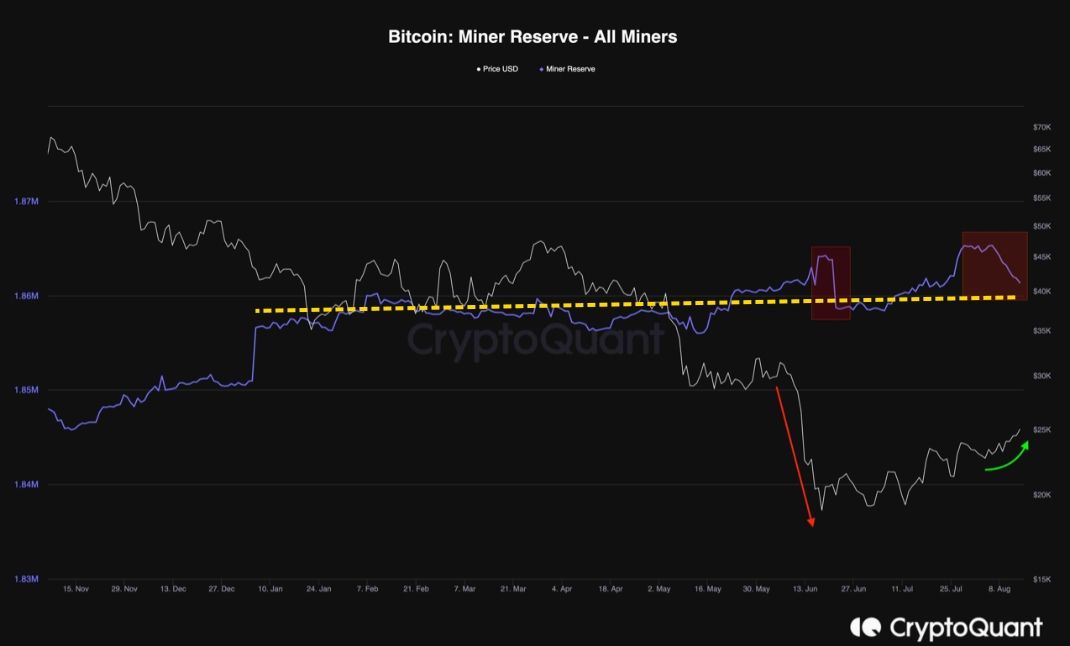

Now look at Bitcoin accumulation by miners. I nabbed this graph from the Bitcoinist, panic selloffs by miners are red boxes, one during a big selloff, the other during the attempted panic rally. That's monetary distress. I added the yellow line... miners aren't holding Bitcoin anymore, they're selling it as fast as they mine it. Another distress signal.

Comments