The collapse and dissolution of the Second Bank of the United States triggered one of the most decentralized and adaptive monetary responses in American history and the responsibility for currency and credit fell upon the States.

In the wake of the Panic of 1837, State governments responded by chartering their own banks and issuing local currencies backed primarily by gold and silver reserves. These "free banks" operated under varying degrees of regulation and issued their own banknotes tied to tangible collateral. This system was far from ideal — fraud, bank runs, and uneven note acceptance were real challenges — but it was a remarkably rapid reboot using decentralized trust and physical reserves.

The relevance to today is striking. Should the Federal Reserve face a catastrophic loss of confidence through hyperinflation, BRICS impact or actions by Trump, it could lose financial authority and States might again become the fallback framework. A tokenized, asset-backed system would echo the 19th-century free banking model but with modern precision and scalability.

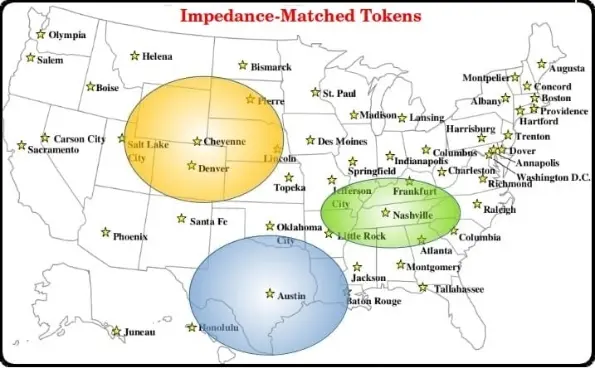

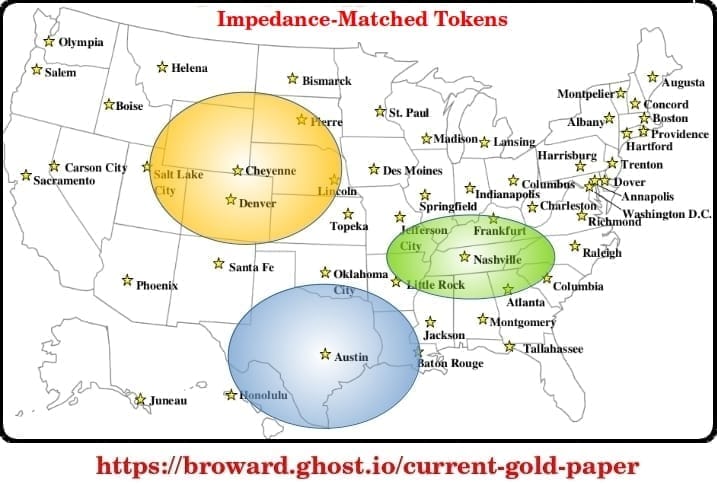

States could issue cryptographic tokens representing allocated gold, auditable and transferable under property law. These systems wouldn’t replace the dollar by force — they would just exist, ready to activate if confidence in federal currency evaporates.

US history shows that when centralized money fails, sovereignty flows to those prepared to hold the line.

Comments