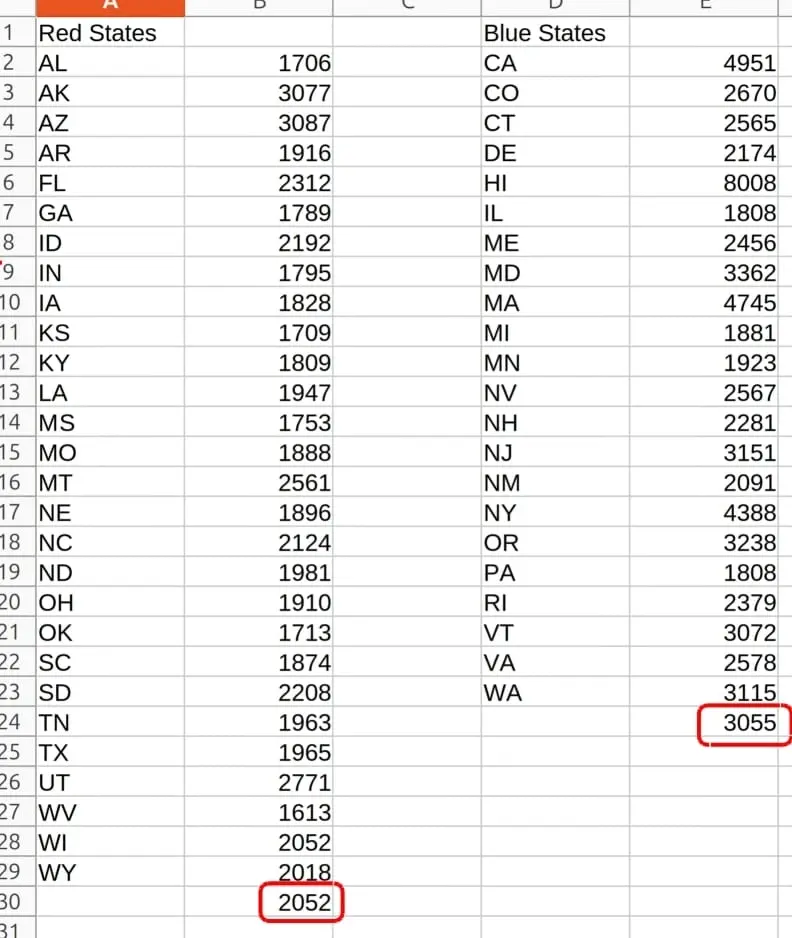

Average mortgage payment for red States versus blue States. The blue States carry about fifty percent more mortgage debt, a monthly payment of $3055 versus $2052. That's a significant factor in inflationary expectations. Debtors tend to favor inflation to dilute away their debt (soft money). Higher debt means higher tendency to vote for inflationary policies and politicians.

This era is like the deflationary Long Depression (1873 to 1896): debtors versus banks, or soft versus hard money. In 1873, the US adopted a hard money policy (gold only) which kicked off the 1873-1878 depression, a shallow depression around 1884, then a third depression from 1893 to 1896, then the FedGov reverted back to soft money, ie gold and silver (bimetallism).

The trend this time is probably the opposite, though. Governments have pursued soft money policy (fiat currency) for the past fifty years, resulting in ridiculous valuations ($36 trillion? really?) and economic distortions which are now manifesting as BRICS initiatives, bank failures, resource wars, a culture of dishonesty and desperation tactics to win elections. The odds favor a reversal to hard money soon but possibly after one last blowoff of hundreds of trillions of dollars.

"Dishonest money creates dishonest people".

Digital currency is NOT hard money, regardless of claims about a "21 million coin limit". When people and organizations get desperate, the rules go out the window. The red States are probably better prepared for a reversal to hard money.

"Debtors never believe debt matters, until they are dangling over a vat of acid."

Comments